Question: QUESTION 4 1 points Sve Answer Which of the following statements regarding overreaction is FALSE? O A After making the standard risk adjustments, the differences

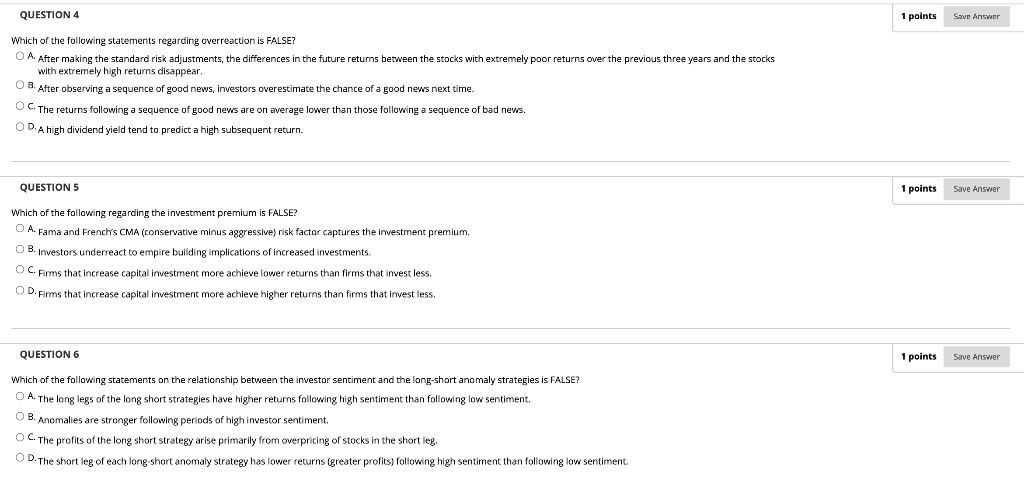

QUESTION 4 1 points Sve Answer Which of the following statements regarding overreaction is FALSE? O A After making the standard risk adjustments, the differences in the future returns between the stocks with extremely poor returns over the previous three years and the stocks with extremely high returns disappear. O B. After observing a sequence of good news, investors overestimate the chance of a good news next time. OCThe returns following a sequence of good news are on average lower than those following a sequence of bad news. OD. A high dividend yield tend to predict a high subsequent return. QUESTION 5 1 points Save Answer Which of the following regarding the investment premium is FALSE? O A. Fama and French's CMA (conservative minus aggressive) risk factor captures the investment premium, OB. Investors underreact to empire building implications of increased investments. OC. Firms that increase capital investment more achieve lower returns than firms that invest less. OD. Firms that increase capital investment more achieve higher returns than firms that invest less. QUESTION 6 1 points Save Answer Which of the following statements on the relationship between the investor sentiment and the long-short anomaly strategies is FALSE? A. The long legs of the long short strategies have higher returns following high sentiment than following low sentiment OB. Anomalies are stronger following periods of high investor sentiment, OC. The profits of the long short strategy arise primarily from overpricing of stocks in the short leg, D. The short leg of each long short anomaly strategy has lower returns (greater profits) following high sentiment than following low sentiment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts