Question: Question 4 1 pts Assume an initial scenario where a levered firm has total assets of $8,000, earnings before interest and taxes of $600,400 shares

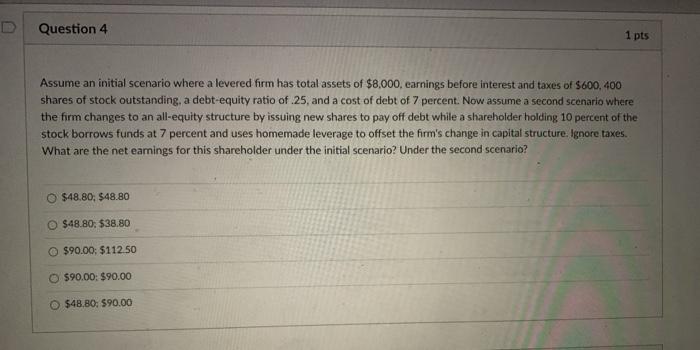

Question 4 1 pts Assume an initial scenario where a levered firm has total assets of $8,000, earnings before interest and taxes of $600,400 shares of stock outstanding, a debt-equity ratio of 25, and a cost of debt of 7 percent. Now assume a second scenario where the firm changes to an all-equity structure by issuing new shares to pay off debt while a shareholder holding 10 percent of the stock borrows funds at 7 percent and uses homemade leverage to offset the firm's change in capital structure. Ignore taxes. What are the net eamings for this shareholder under the initial scenario? Under the second scenario? O $48.80: $48.80 $48.80: $38.80 $90.00: $112.50 $90.00: $90.00 $48.80: 590.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts