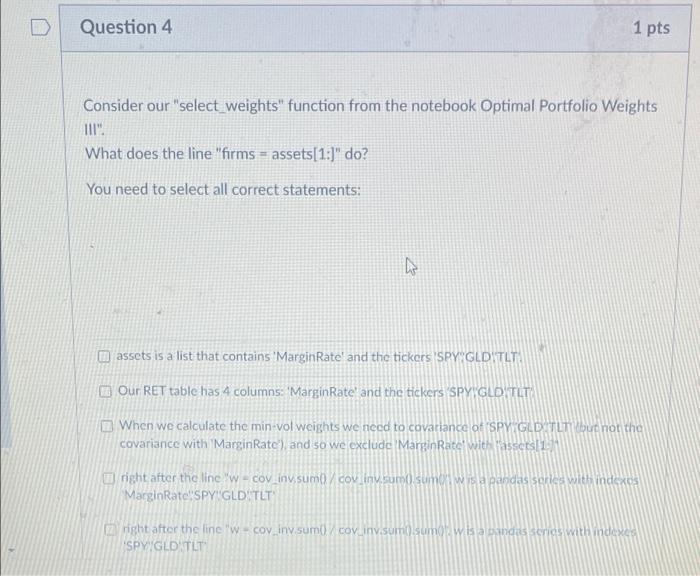

Question: Question 4 1 pts Consider our select_weights function from the notebook Optimal Portfolio Weights III. What does the line firms = assets[1:] do? You need

![Optimal Portfolio Weights III". What does the line "firms = assets[1:]" do?](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe5d7e1b18b_10966fe5d7da5cae.jpg)

Question 4 1 pts Consider our "select_weights" function from the notebook Optimal Portfolio Weights III". What does the line "firms = assets[1:]" do? You need to select all correct statements: assets is a list that contains 'Margin Rate' and the tickers SPY GLD TLT Our RET table has 4 columns: "Margin Rate and the tickers SPY GLDYTLT When we calculate the min-vol weights we necd to covariance of SPY GLD TLT but not the covariance with Margin Rate) and so we exclude 'Marginate with acts right after the line 'w-covinvsum coviny.cum sumiwisa pandas schice with indexes Marginate SPY"GLD TLT right after the line "w - coviny.sumcoviny.sum) sumo wa bindiscries with index SPIGEO TT assets is a list that contains 'Margin Rate and the tickers 'SPYGLDTLT. Our RET table has 4 columns: 'MarginRate' and the tickers 'SPY"GLDTLT. When we calculate the min-vol weights we need to covariance of 'SPY GLDTLT (but not the covariance with 'MarginRate'), and so we exclude 'Marginate with "assets(1:)" right after the line "w = cov_inv.sumo / cov_inv.sumy.sum". w is a pandas series with indexes "MarginRateSPY GLD TLT right after the line "W cov_inv.sum() / cov_inv.sum().sum()". wis a pandas series with indexes 'SPY GLD TLT Dif. inside 'get_assets()", we have "assets - ('SPY"GLDTLT"MarginRatel' then we need to write forms = assetsl-1:]" in "select_weights if, inside "get_assets()". we have "assets - 'SPY"GLD TLT Marsin Rate then we need to write "firms - assets: 1)" in "select_weights Question 4 1 pts Consider our "select_weights" function from the notebook Optimal Portfolio Weights III". What does the line "firms = assets[1:]" do? You need to select all correct statements: assets is a list that contains 'Margin Rate' and the tickers SPY GLD TLT Our RET table has 4 columns: "Margin Rate and the tickers SPY GLDYTLT When we calculate the min-vol weights we necd to covariance of SPY GLD TLT but not the covariance with Margin Rate) and so we exclude 'Marginate with acts right after the line 'w-covinvsum coviny.cum sumiwisa pandas schice with indexes Marginate SPY"GLD TLT right after the line "w - coviny.sumcoviny.sum) sumo wa bindiscries with index SPIGEO TT assets is a list that contains 'Margin Rate and the tickers 'SPYGLDTLT. Our RET table has 4 columns: 'MarginRate' and the tickers 'SPY"GLDTLT. When we calculate the min-vol weights we need to covariance of 'SPY GLDTLT (but not the covariance with 'MarginRate'), and so we exclude 'Marginate with "assets(1:)" right after the line "w = cov_inv.sumo / cov_inv.sumy.sum". w is a pandas series with indexes "MarginRateSPY GLD TLT right after the line "W cov_inv.sum() / cov_inv.sum().sum()". wis a pandas series with indexes 'SPY GLD TLT Dif. inside 'get_assets()", we have "assets - ('SPY"GLDTLT"MarginRatel' then we need to write forms = assetsl-1:]" in "select_weights if, inside "get_assets()". we have "assets - 'SPY"GLD TLT Marsin Rate then we need to write "firms - assets: 1)" in "select_weights

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts