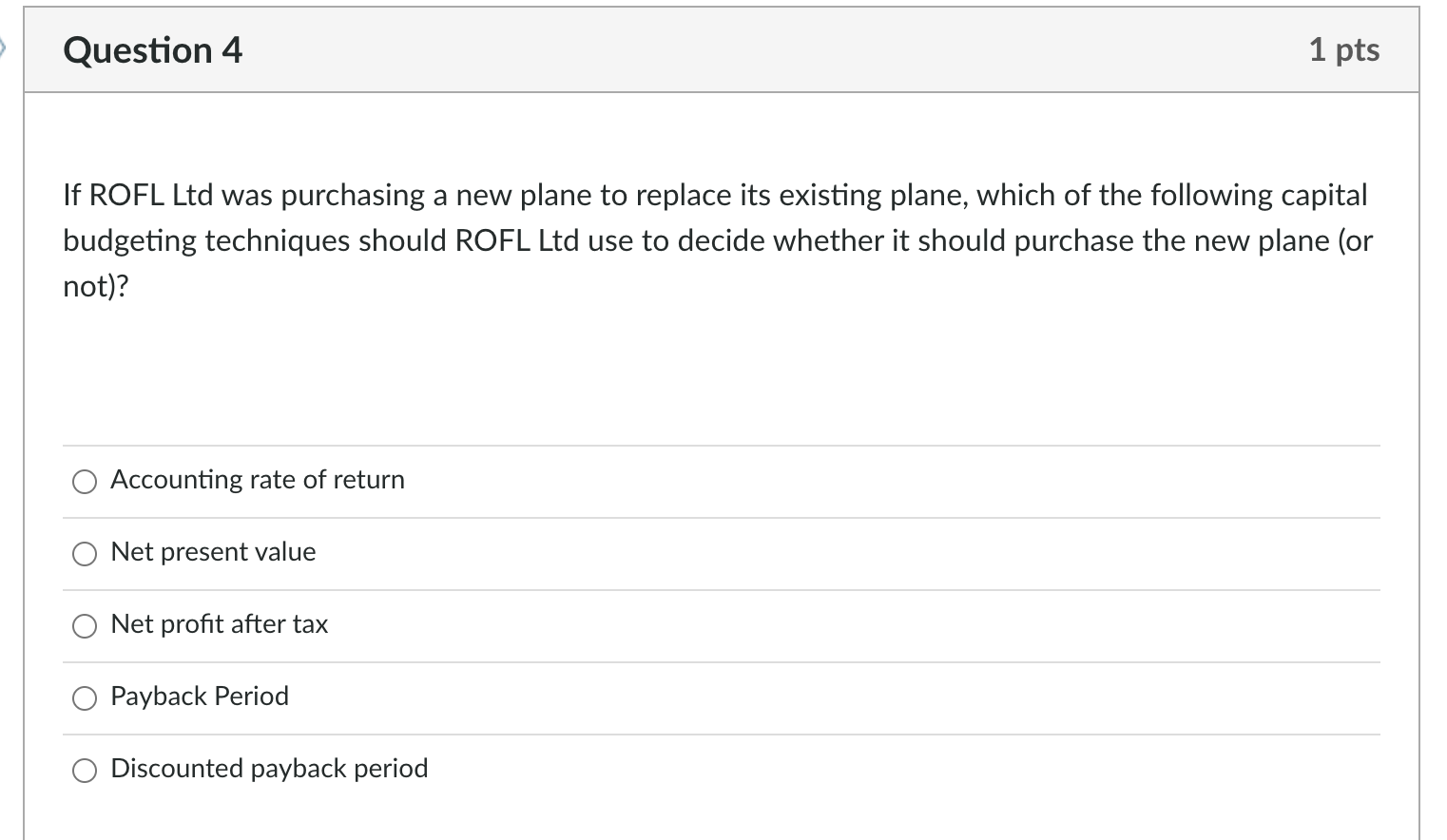

Question: Question 4 1 pts If ROFL Ltd was purchasing a new plane to replace its existing plane, which of the following capital budgeting techniques should

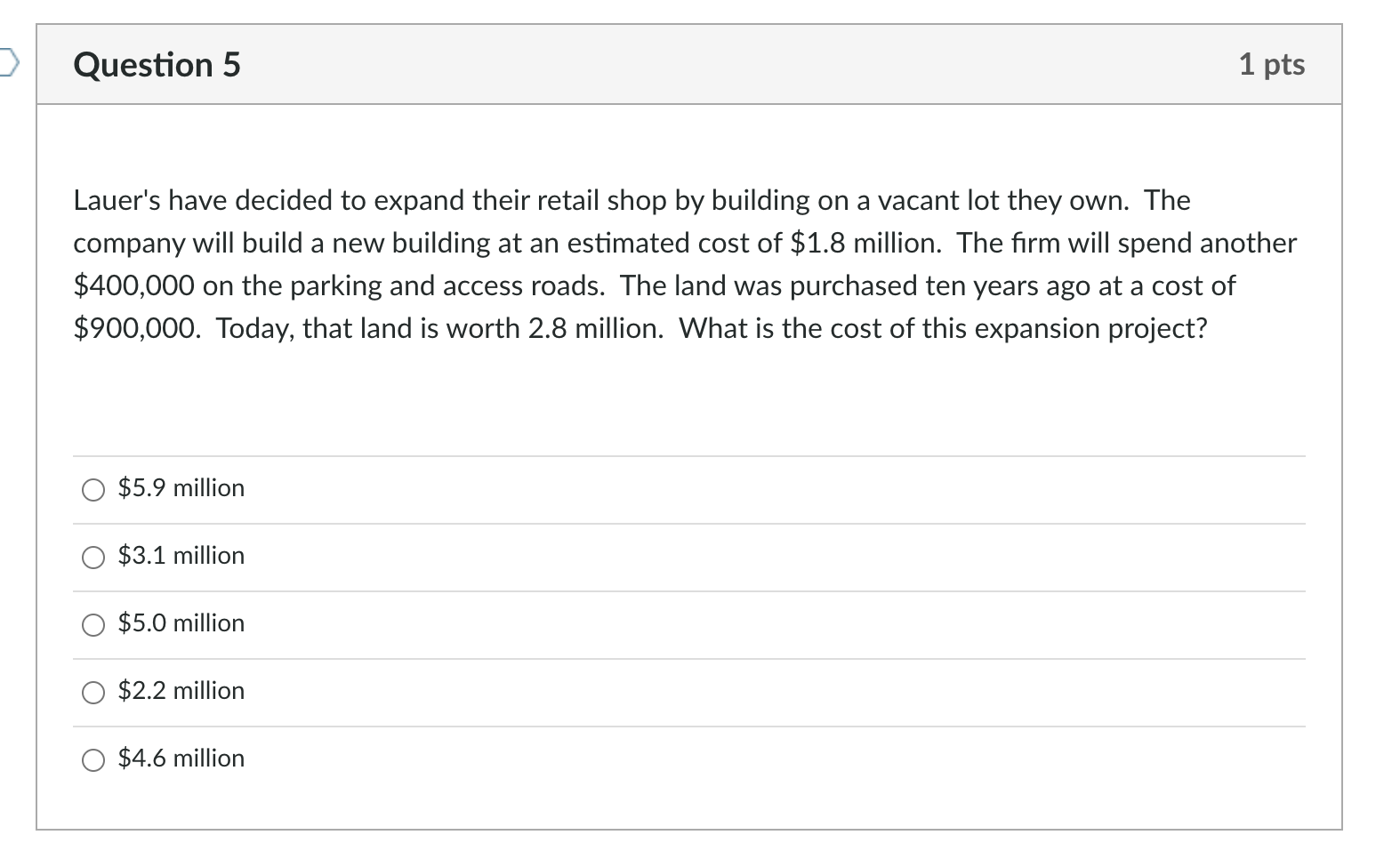

Question 4 1 pts If ROFL Ltd was purchasing a new plane to replace its existing plane, which of the following capital budgeting techniques should ROFL Ltd use to decide whether it should purchase the new plane (or not)? Accounting rate of return Net present value Net profit after tax Payback Period Discounted payback period Question 5 1 pts Lauer's have decided to expand their retail shop by building on a vacant lot they own. The company will build a new building at an estimated cost of $1.8 million. The firm will spend another $400,000 on the parking and access roads. The land was purchased ten years ago at a cost of $900,000. Today, that land is worth 2.8 million. What is the cost of this expansion project? $5.9 million $3.1 million $5.0 million $2.2 million O $4.6 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts