Question: Question 4 - (10 marks) 1 mark for each journal entry line: Correct account (0.5) and Correct Amount (0.5) - Note: if the account is

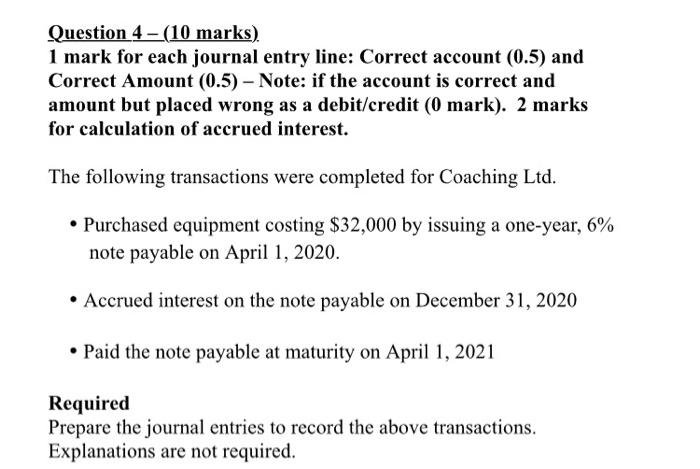

Question 4 - (10 marks) 1 mark for each journal entry line: Correct account (0.5) and Correct Amount (0.5) - Note: if the account is correct and amount but placed wrong as a debit/credit (0 mark). 2 marks for calculation of accrued interest. The following transactions were completed for Coaching Ltd. Purchased equipment costing $32,000 by issuing a one-year, 6% note payable on April 1, 2020. Accrued interest on the note payable on December 31, 2020 Paid the note payable at maturity on April 1, 2021 Required Prepare the journal entries to record the above transactions. Explanations are not required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts