Question: Question 4 (10 marks) Stock A has an expected return of 20% and a standard deviation of 8%. Ken is indifferent between stock A and

Question 4 (10 marks)

Stock A has an expected return of 20% and a standard deviation of 8%. Ken is indifferent

between stock A and a risk-free investment that offers 12% return. On the other hand, Nick is

indifferent between stock A and a risk-free investment that offers 9% return. Other things being

equal, who is more likely to invest in a lower risk portfolio? Why?

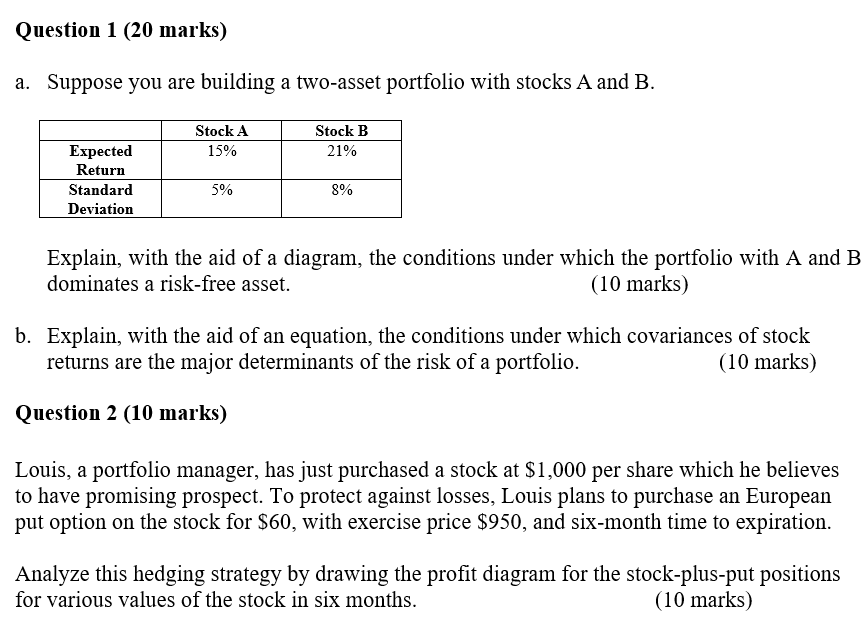

Question 1 (20 marks) a. Suppose you are building a two-asset portfolio with stocks A and B. Stock A 15% Stock B 21% Expected Return Standard Deviation 5% 8% Explain, with the aid of a diagram, the conditions under which the portfolio with A and B dominates a risk-free asset. (10 marks) b. Explain, with the aid of an equation, the conditions under which covariances of stock returns are the major determinants of the risk of a portfolio. (10 marks) Question 2 (10 marks) Louis, a portfolio manager, has just purchased a stock at $1,000 per share which he believes to have promising prospect. To protect against losses, Louis plans to purchase an European put option on the stock for $60, with exercise price $950, and six-month time to expiration. Analyze this hedging strategy by drawing the profit diagram for the stock-plus-put positions for various values of the stock in six months. (10 marks) Question 1 (20 marks) a. Suppose you are building a two-asset portfolio with stocks A and B. Stock A 15% Stock B 21% Expected Return Standard Deviation 5% 8% Explain, with the aid of a diagram, the conditions under which the portfolio with A and B dominates a risk-free asset. (10 marks) b. Explain, with the aid of an equation, the conditions under which covariances of stock returns are the major determinants of the risk of a portfolio. (10 marks) Question 2 (10 marks) Louis, a portfolio manager, has just purchased a stock at $1,000 per share which he believes to have promising prospect. To protect against losses, Louis plans to purchase an European put option on the stock for $60, with exercise price $950, and six-month time to expiration. Analyze this hedging strategy by drawing the profit diagram for the stock-plus-put positions for various values of the stock in six months. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts