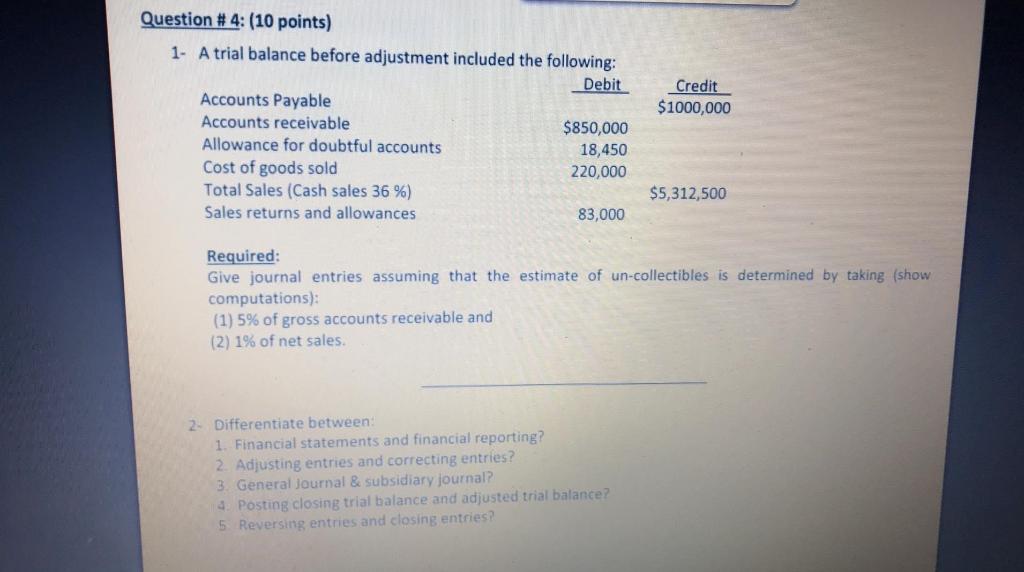

Question: Question # 4: (10 points) 1. A trial balance before adjustment included the following: Debit Accounts Payable Accounts receivable $850,000 Allowance for doubtful accounts 18,450

Question # 4: (10 points) 1. A trial balance before adjustment included the following: Debit Accounts Payable Accounts receivable $850,000 Allowance for doubtful accounts 18,450 Cost of goods sold 220,000 Total Sales (Cash sales 36 %) Sales returns and allowances 83,000 Credit $1000,000 $5,312,500 Required: Give journal entries assuming that the estimate of un-collectibles is determined by taking (show computations): (1) 5% of gross accounts receivable and (2) 1% of net sales. 2 Differentiate between 1. Financial statements and financial reporting? 2. Adjusting entries and correcting entries? 3. General Journal & subsidiary journal? 4. Posting closing trial balance and adjusted trial balance? 5. Reversing entries and closing entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts