Question: Question 4 (10 points -2.5 each) Circle 1 answer for each of the following questions. Explain in 1 or 2 sentences your choice (unjustified answers

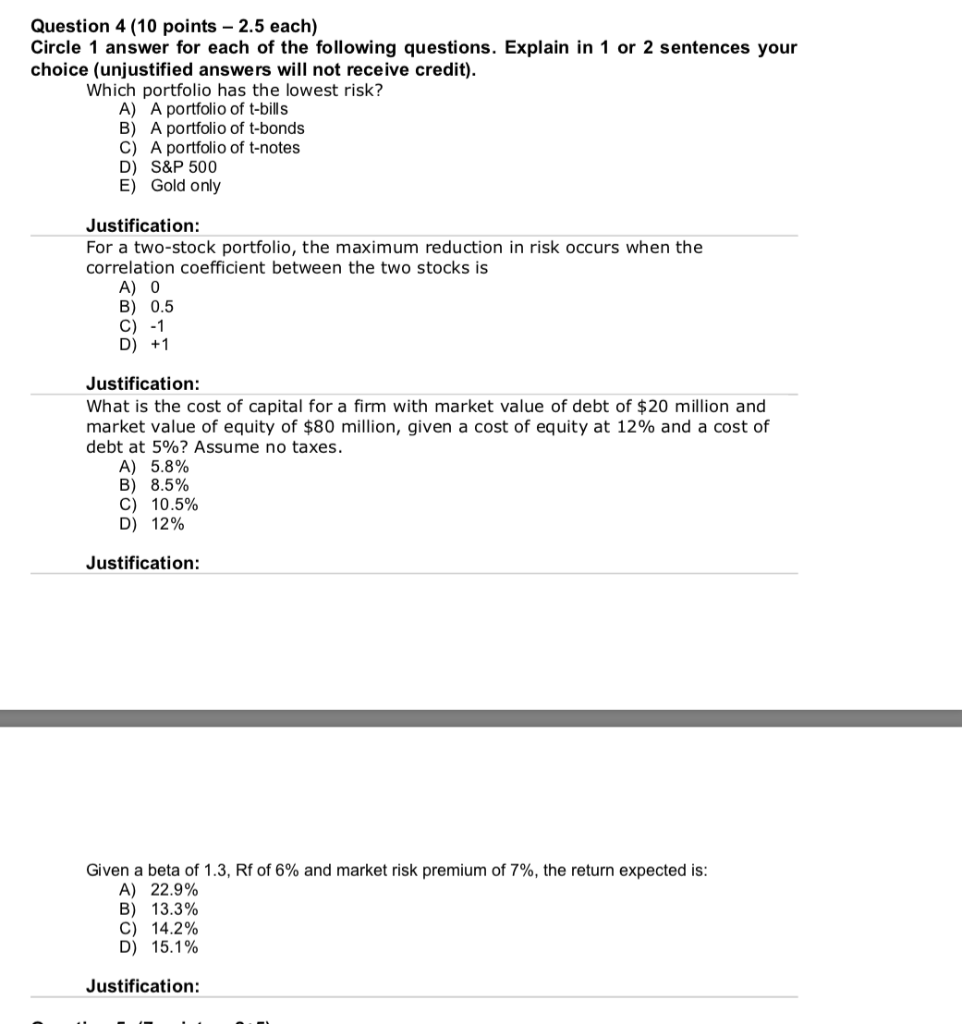

Question 4 (10 points -2.5 each) Circle 1 answer for each of the following questions. Explain in 1 or 2 sentences your choice (unjustified answers will not receive credit). Which portfolio has the lowest risk? A) A portfolio of t-bills B) A portfolio of t-bonds C) A portfolio of t-notes D) S&P 500 E) Gold only Justification: For a two-stock portfolio, the maximum reduction in risk occurs when the correlation coefficient between the two stocks is A) 0 B) 0.5 C) -1 D) +1 Justification: What is the cost of capital for a firm with market value of debt of $20 million and market value of equity of $80 million, given a cost of equity at 12% and a cost of debt at 5%? Assume no taxes. A) 5.8% B) 8.5% c) 10.5% D) 12% Justification: Given a beta of 1.3, Rf of 6% and market risk premium of 7%, the return expected is: A) 22.9% B) 13.3% C) 14.2% D) 15.1% Justification

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts