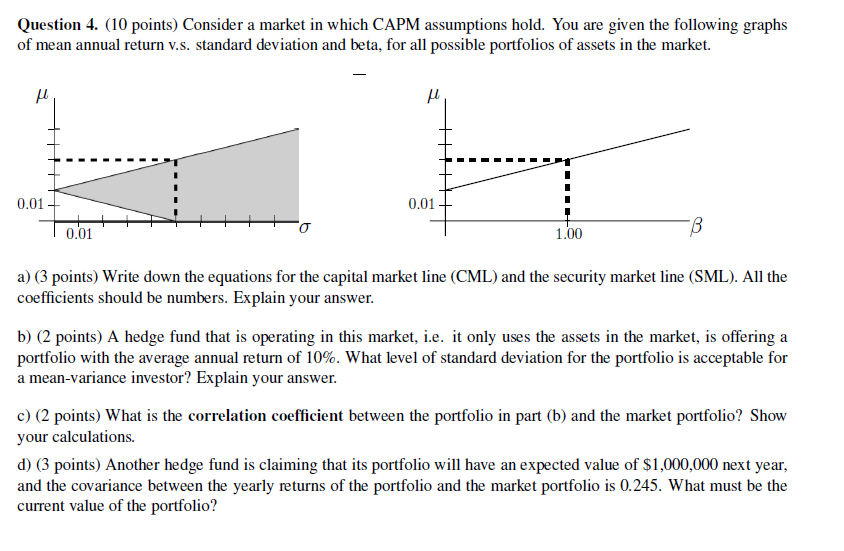

Question: Question 4. (10 points) Consider a market in which CAPM assumptions hold. You are given the following graphs of mean annual return v.s. standard deviation

Question 4. (10 points) Consider a market in which CAPM assumptions hold. You are given the following graphs of mean annual return v.s. standard deviation and beta, for all possible portfolios of assets in the market. u 0.01 0.01 o 0.01 1.00 B a) (3 points) Write down the equations for the capital market line (CML) and the security market line (SML). All the coefficients should be numbers. Explain your answer. b) (2 points) A hedge fund that is operating in this market, i.e. it only uses the assets in the market, is offering a portfolio with the average annual return of 10%. What level of standard deviation for the portfolio is acceptable for a mean-variance investor? Explain your answer. c) (2 points) What is the correlation coefficient between the portfolio in part (b) and the market portfolio? Show your calculations. d) (3 points) Another hedge fund is claiming that its portfolio will have an expected value of $1,000,000 next year, and the covariance between the yearly returns of the portfolio and the market portfolio is 0.245. What must be the current value of the portfolio? Question 4. (10 points) Consider a market in which CAPM assumptions hold. You are given the following graphs of mean annual return v.s. standard deviation and beta, for all possible portfolios of assets in the market. u 0.01 0.01 o 0.01 1.00 B a) (3 points) Write down the equations for the capital market line (CML) and the security market line (SML). All the coefficients should be numbers. Explain your answer. b) (2 points) A hedge fund that is operating in this market, i.e. it only uses the assets in the market, is offering a portfolio with the average annual return of 10%. What level of standard deviation for the portfolio is acceptable for a mean-variance investor? Explain your answer. c) (2 points) What is the correlation coefficient between the portfolio in part (b) and the market portfolio? Show your calculations. d) (3 points) Another hedge fund is claiming that its portfolio will have an expected value of $1,000,000 next year, and the covariance between the yearly returns of the portfolio and the market portfolio is 0.245. What must be the current value of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts