Question: Question #4 (10 points) Consider an exchange-traded call option contract to buy 500 shares with a strike price of $40 and maturity in four months.

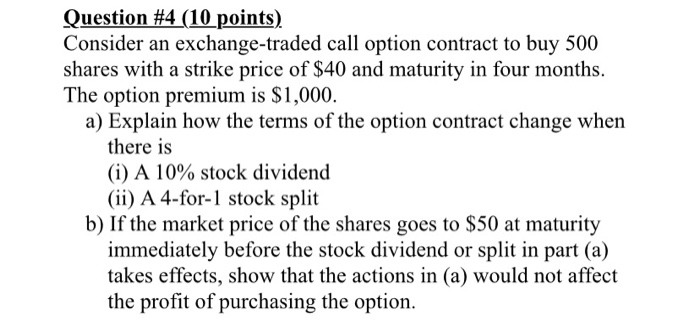

Question #4 (10 points) Consider an exchange-traded call option contract to buy 500 shares with a strike price of $40 and maturity in four months. The option premium is $1,000. a) Explain how the terms of the option contract change when there is (i) A 10% stock dividend (ii) A 4-for-1 stock split b) If the market price of the shares goes to $50 at maturity immediately before the stock dividend or split in part (a) takes effects, show that the actions in (a) would not affect the profit of purchasing the option

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock