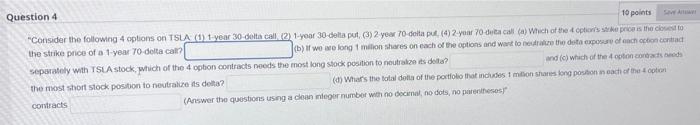

Question: Question 4 10 points Consider the following 4 options on TSLA (1) 1-year 30-delta call, (2) 1-year 30-delta put, (3) 2-year 70-delta put, (4) 2-year

Question 4 10 points "Consider the following 4 options on TSLA (1) 1-year 30-delta call, (2) 1-year 30-delta put, (3) 2-year 70-delta put, (4) 2-year 70-deta call (a) Which of the 4 option's strike price is the closest to (b) If we are long 1 million shares on each of the options and want to neutralize the deta exposure of each option contract the strike price of a 1-year 70-delta call? and (c) which of the 4 option contracts needs separately with TSLA stock, which of the 4 option contracts needs the most long stock position to neutralize its delta? the most short stock position to neutralize its delta? contracts (d) What's the total delta of the portfolio that includes 1 milion shares long position in each of the 4 option (Answer the questions using a clean integer number with no decimal, no dots, no parentheses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts