Question: Question 4 10 points Save Answer Help the Norwegian oil company Statoil decide whether or not to finance exploratory oil wells in a certain part

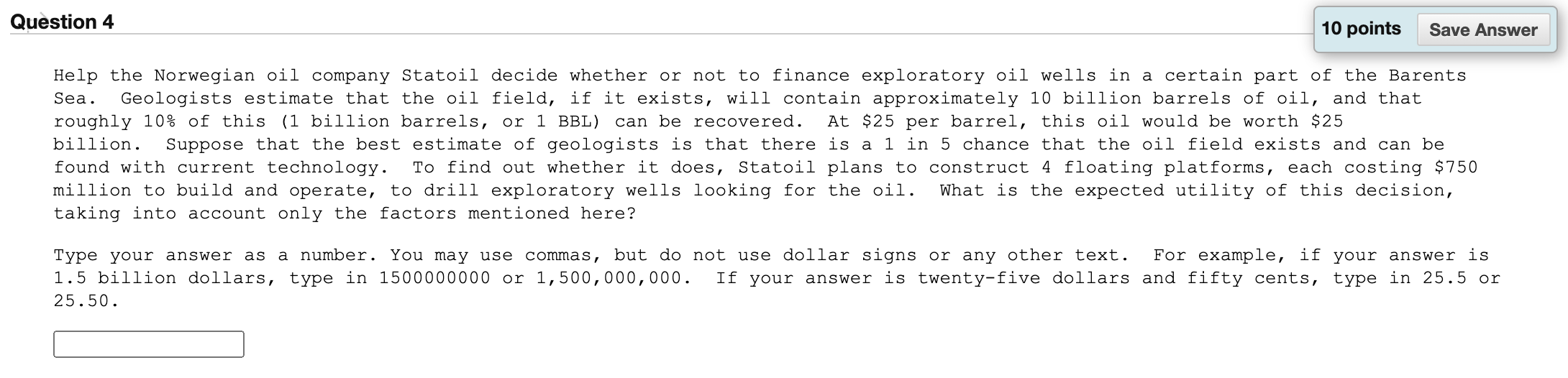

Question 4 10 points Save Answer Help the Norwegian oil company Statoil decide whether or not to finance exploratory oil wells in a certain part of the Barents Sea. Geologists estimate that the oil field, if it exists, will contain approximately 10 billion barrels of oil, and that roughly 10% of this (1 billion barrels, or 1 BBL) can be recovered. At $25 per barrel, this oil would be worth $25 billion. Suppose that the best estimate of geologists is that there is a 1 in 5 chance that the oil field exists and can be found with current technology. To find out whether it does, Statoil plans to construct 4 floating platforms, each costing $750 million to build and operate, to drill exploratory wells looking for the oil. What is the expected utility of this decision, taking into account only the factors mentioned here? Type your answer as a number. You may use commas, but do not use dollar signs or any other text. For example, if your answer is 1.5 billion dollars, type in 1500000000 or 1,500,000,000. If your answer is twenty-five dollars and fifty cents, type in 25.5 or 25.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts