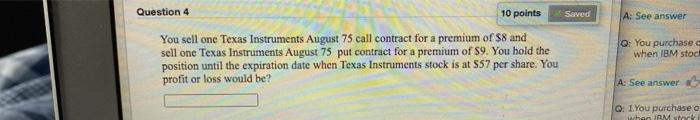

Question: Question 4 10 points Saved A: See answer Q: You purchase when IBM stod You sell one Texas Instruments August 75 call contract for a

Question 4 10 points Saved A: See answer Q: You purchase when IBM stod You sell one Texas Instruments August 75 call contract for a premium of $8 and sell one Texas Instruments August 75 put contract for a premium of $9. You hold the position until the expiration date when Texas Instruments stock is at $57 per share. You profit or loss would be? A: See answer Q: 1. You purchase o han RM st

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts