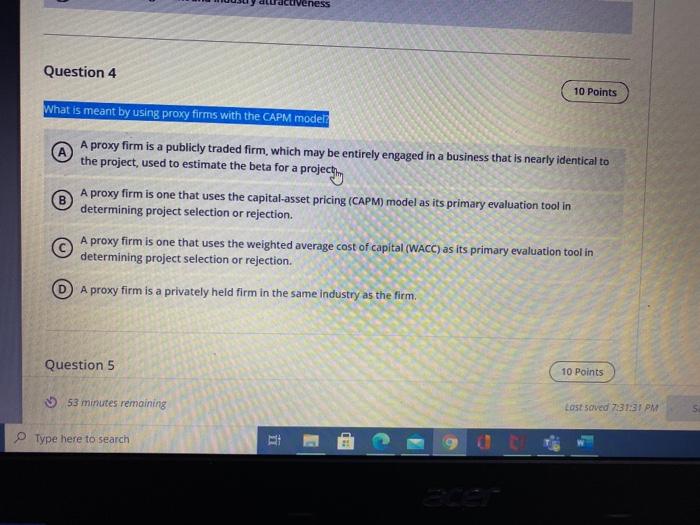

Question: Question 4 10 Points What is meant by using proxy firms with the CAPM model a projecting B A proxy firm is a publicly traded

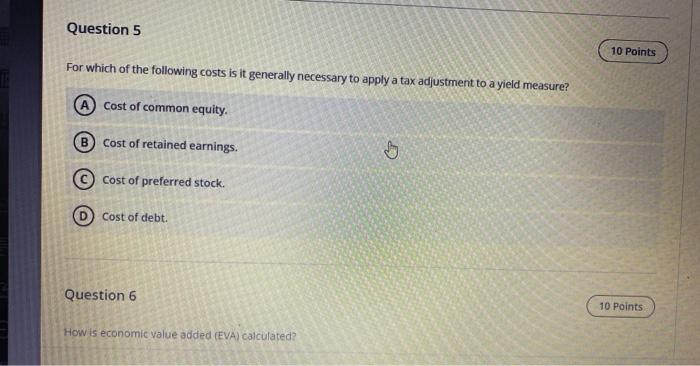

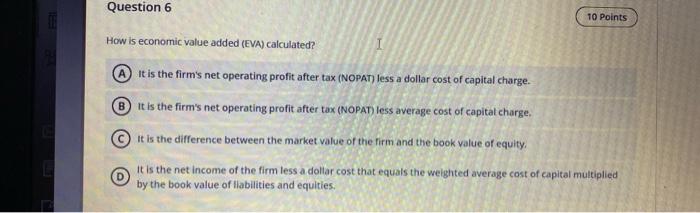

Question 4 10 Points What is meant by using proxy firms with the CAPM model a projecting B A proxy firm is a publicly traded firm, which may be entirely engaged in a business that is nearly identical to the project, used to estimate the beta for a A proxy firm is one that uses the capital-asset pricing (CAPM) model as its primary evaluation tool in determining project selection or rejection A proxy firm is one that uses the weighted average cost of capital (WACC) as its primary evaluation tool in determining project selection or rejection. A proxy firm is a privately held firm in the same industry as the firm. Question 5 10 Points 53 minutes remaining Last saved 7:31:31 PM Type here to search i E Question 5 10 Points For which of the following costs is it generally necessary to apply a tax adjustment to a yield measure? Cost of common equity. B Cost of retained earnings. cost of preferred stock. Cost of debt. Question 6 10 Points How is economic value added (EVA) calculated? Question 6 10 Points How is economic value added (EVA) calculated? it is the firm's net operating profit after tax (NOPAT) less a dollar cost of capital charge. it is the firm's net operating profit after tax (NOPAT) less average cost of capital charge, It is the difference between the market value of the firm and the book value of equity, It is the net income of the firm less a dollar cost that equals the weighted average cost of capital multiplied by the book value of liabilities and equities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts