Question: Question 4. (1000 words maximum, 30 marks in total) a) A company in the United States received an invoice of 200,000 from a firm in

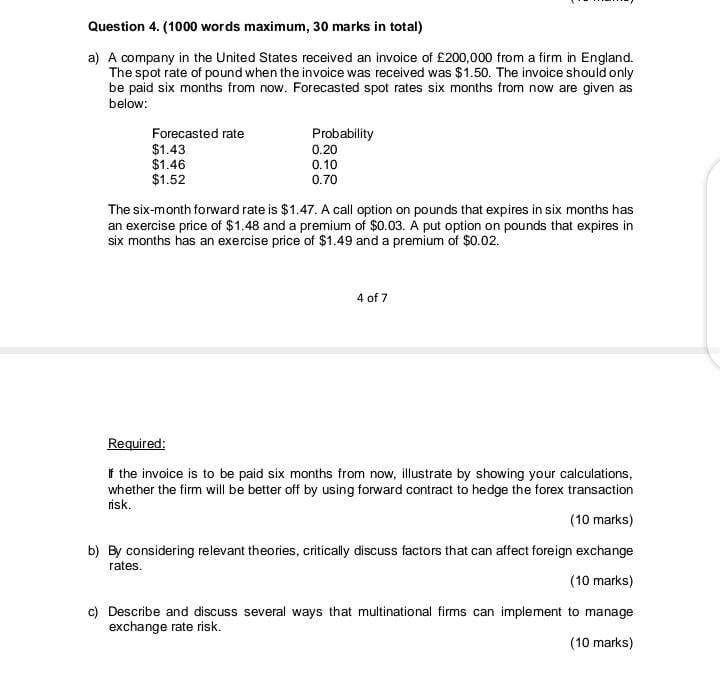

Question 4. (1000 words maximum, 30 marks in total) a) A company in the United States received an invoice of 200,000 from a firm in England. The spot rate of pound when the invoice was received was $1.50. The invoice should only be paid six months from now. Forecasted spot rates six months from now are given as below: The six-month forward rate is $1.47. A call option on pounds that expires in six month has an exercise price of $1.48 and a premium of $0.03. A put option on pounds that expires in six months has an exercise price of $1.49 and a premium of $0.02. 4 of 7 Required: If the invoice is to be paid six months from now, illustrate by showing your calculations, whether the firm will be better off by using forward contract to hedge the forex transaction nisk. (10 marks) b) By considering relevant theories, critically discuss factors that can affect foreign exchange rates. (10 marks) c) Describe and discuss several ways that multinational firms can implement to manage exchange rate risk. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts