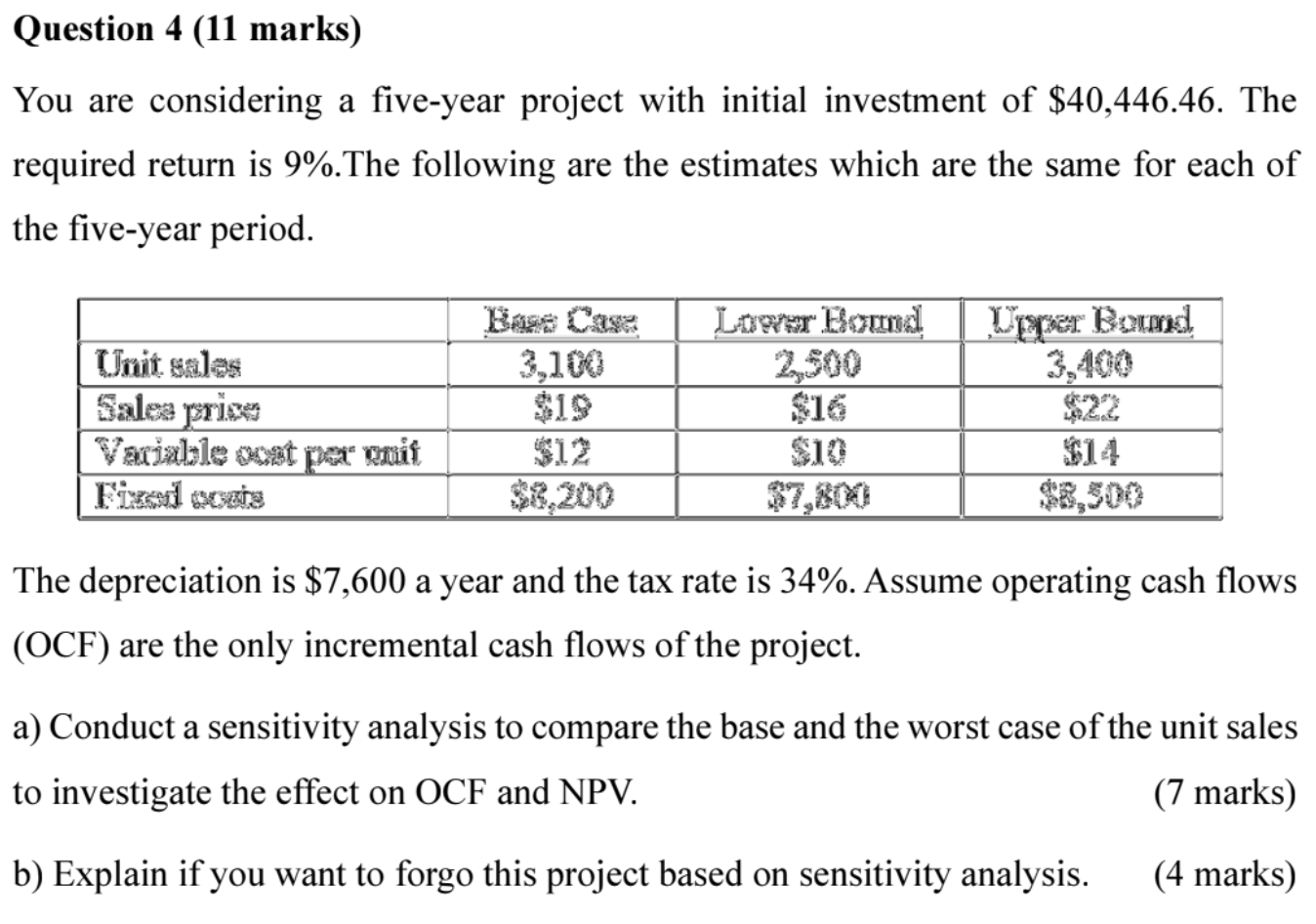

Question: Question 4 (11 marks) You are considering a five-year project with initial investment of $40,446.46. The required return is 9%.The following are the estimates which

Question 4 (11 marks) You are considering a five-year project with initial investment of $40,446.46. The required return is 9%.The following are the estimates which are the same for each of the five-year period. LOST Bond Upper Bound Unit salas Salea prica Vacjalle ocat pa enit Bizi socis 3,100 $19 $12 $8,200 $7,800 $8,500 The depreciation is $7,600 a year and the tax rate is 34%. Assume operating cash flows (OCF) are the only incremental cash flows of the project. a) Conduct a sensitivity analysis to compare the base and the worst case of the unit sales to investigate the effect on OCF and NPV. (7 marks) b) Explain if you want to forgo this project based on sensitivity analysis. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts