Question: Question 4 (13 marks) Wallace, a fund manager, is evaluating common stock value of Upbox Company, a video conference platform provider. He decides to use

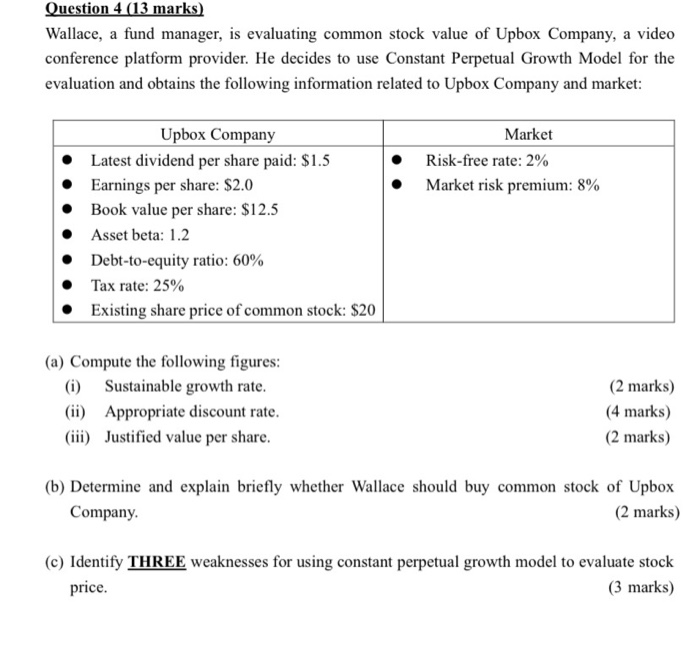

Question 4 (13 marks) Wallace, a fund manager, is evaluating common stock value of Upbox Company, a video conference platform provider. He decides to use Constant Perpetual Growth Model for the evaluation and obtains the following information related to Upbox Company and market: Market Risk-free rate: 2% Market risk premium: 8% Upbox Company Latest dividend per share paid: $1.5 Earnings per share: $2.0 Book value per share: $12.5 Asset beta: 1.2 Debt-to-equity ratio: 60% Tax rate: 25% Existing share price of common stock: $20 (a) Compute the following figures: (i) Sustainable growth rate. (ii) Appropriate discount rate. (iii) Justified value per share. (2 marks) (4 marks) (2 marks) (b) Determine and explain briefly whether Wallace should buy common stock of Upbox Company. (2 marks) (c) Identify THREE weaknesses for using constant perpetual growth model to evaluate stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts