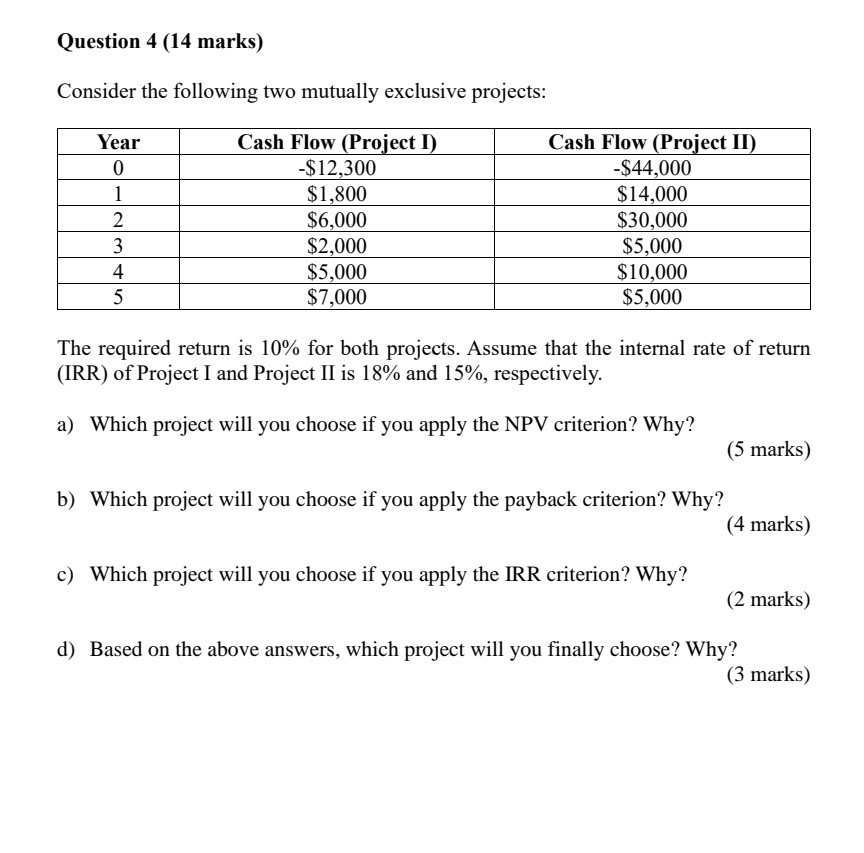

Question: Question 4 (14 marks) Consider the following two mutually exclusive projects: Year 0 1 Cash Flow (Project I) -$12,300 $1,800 $6,000 $2,000 $5,000 $7,000 2

Question 4 (14 marks) Consider the following two mutually exclusive projects: Year 0 1 Cash Flow (Project I) -$12,300 $1,800 $6,000 $2,000 $5,000 $7,000 2 3 4 5 Cash Flow (Project II) -$44,000 $14,000 $30,000 $5,000 $10,000 $5,000 UA The required return is 10% for both projects. Assume that the internal rate of return (IRR) of Project I and Project II is 18% and 15%, respectively. a) Which project will you choose if you apply the NPV criterion? Why? (5 marks) b) Which project will you choose if you apply the payback criterion? Why? (4 marks) c) Which project will you choose if you apply the IRR criterion? Why? (2 marks) d) Based on the above answers, which project will you finally choose? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts