Question: Question 4 --/14 View Policies Current Attempt in Progress Marshall Ltd. prepares an aging schedule for its accounts receivable at the end of each month

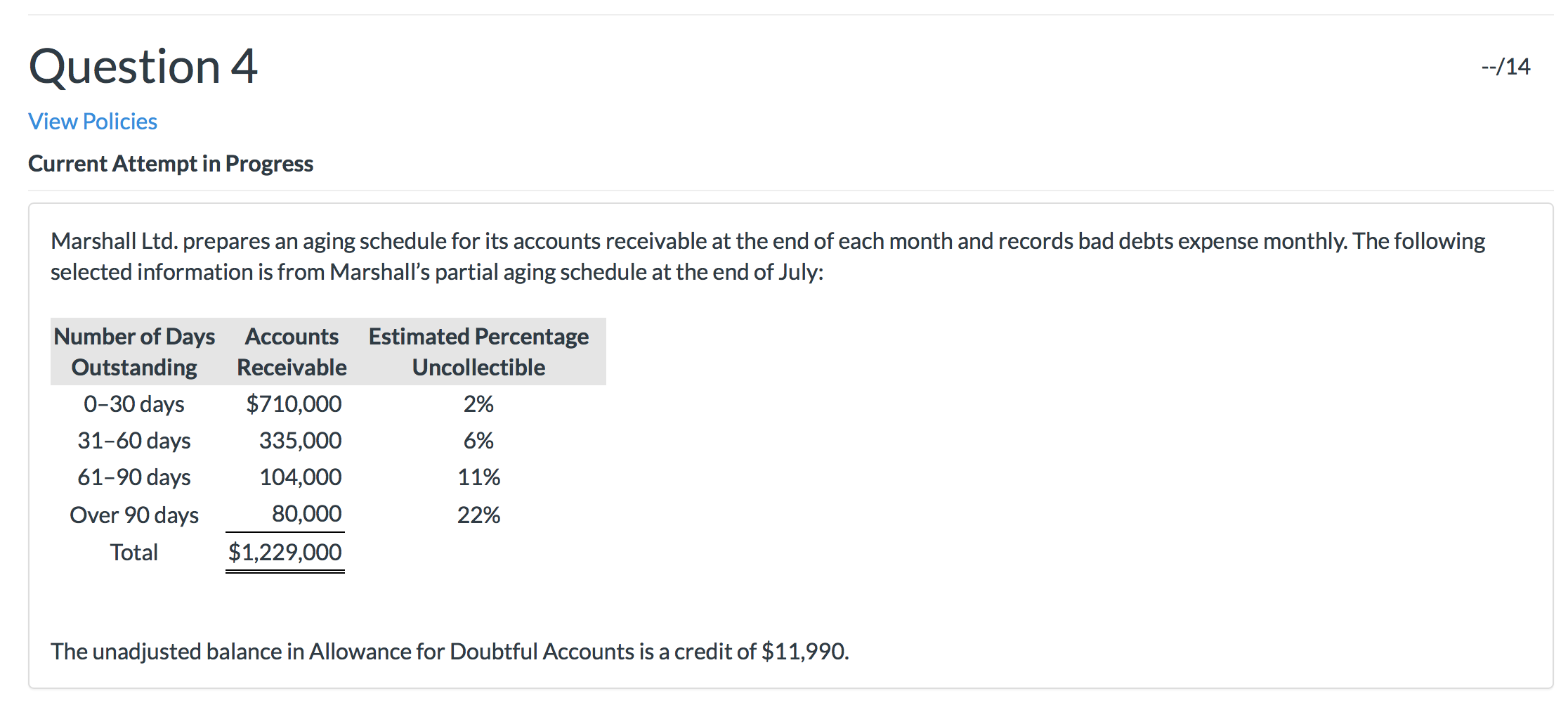

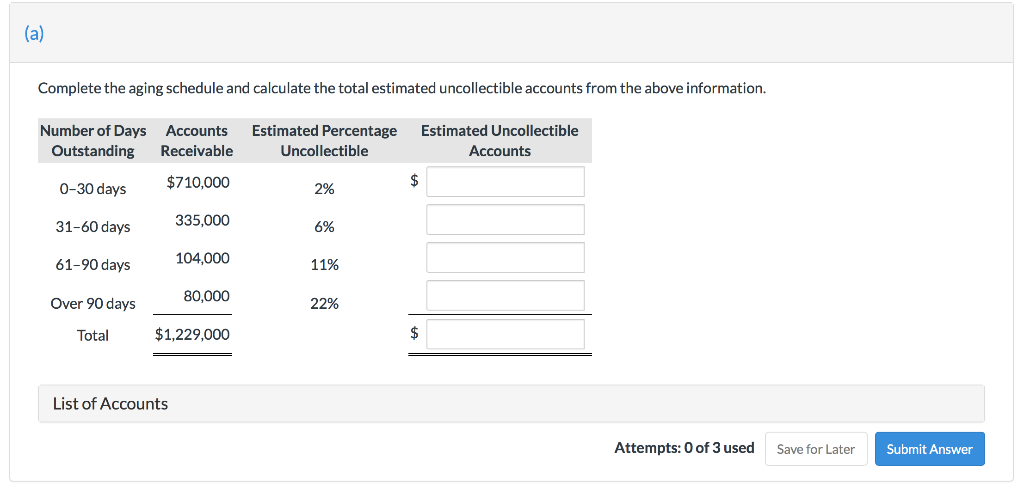

Question 4 --/14 View Policies Current Attempt in Progress Marshall Ltd. prepares an aging schedule for its accounts receivable at the end of each month and records bad debts expense monthly. The following selected information is from Marshall's partial aging schedule at the end of July: Estimated Percentage Uncollectible 2% Number of Days Accounts Outstanding Receivable 0-30 days $710,000 31-60 days 335,000 61-90 days 104,000 Over 90 days 80,000 Total $1,229,000 6% 11% 22% $1.29 The unadjusted balance in Allowance for Doubtful Accounts is a credit of $11,990. Complete the aging schedule and calculate the total estimated uncollectible accounts from the above information. Number of Days Accounts Outstanding Receivable Estimated Percentage Uncollectible Estimated Uncollectible Accounts 0-30 days $710,000 2% 31-60 days 335,000 6% 61-90 days 104,000 11% 80,000 22% Over 90 days Total $1,229,000 List of Accounts Attempts: 0 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts