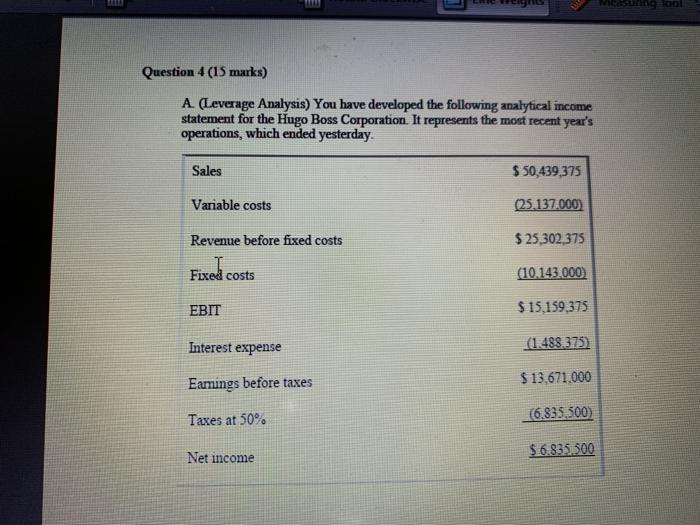

Question: Question 4 (15 marks) A. (Leverage Analysis) You have developed the following analytical income statement for the Hugo Boss Corporation. It represents the most recent

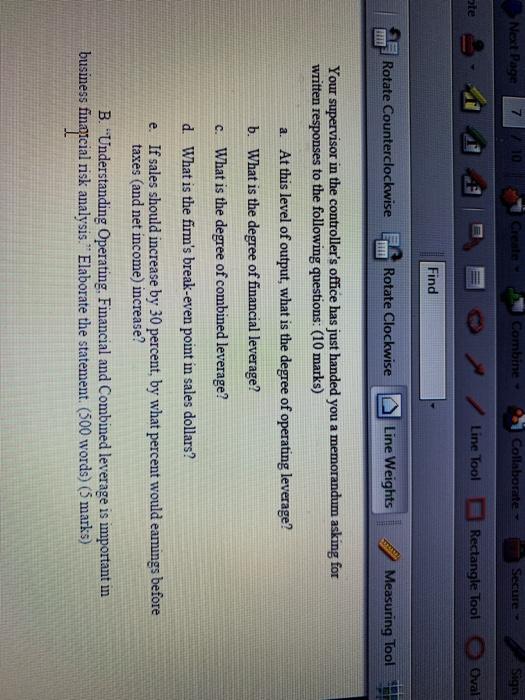

Question 4 (15 marks) A. (Leverage Analysis) You have developed the following analytical income statement for the Hugo Boss Corporation. It represents the most recent year's operations, which ended yesterday Sales $ 50,439,375 Variable costs (25.137.000) $ 25,302,375 Revenue before fixed costs Fixed costs (10.143.000) EBIT $ 15,159,375 Interest expense (1.488.375) Earnings before taxes $ 13,671.000 Taxes at 50% (6.835.500) $6.835.500 Net income Next Page Combine Collaborate- Secure- Sign te Line Tool Rectangle Tool Oval Find Rotate Counterclockwise Rotate Clockwise Line Weights Measuring Tool Your supervisor in the controller's office has just handed you a memorandum asking for written responses to the following questions: (10 marks) 2. At this level of output, what is the degree of operating leverage? b. What is the degree of financial leverage? c. What is the degree of combined leverage? d. What is the firm's break-even point in sales dollars? e. If sales should increase by 30 percent, by what percent would eamings before taxes (and net income) increase? B. "Understanding Operating, Financial and Combined leverage is important in business financial risk analysis." Elaborate the statement. (500 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts