Question: Question 4 (15 marks) Bugis Company has a net operating profit of $380,000 and operating assets of $2,000,000. The company requires a minimum required rate

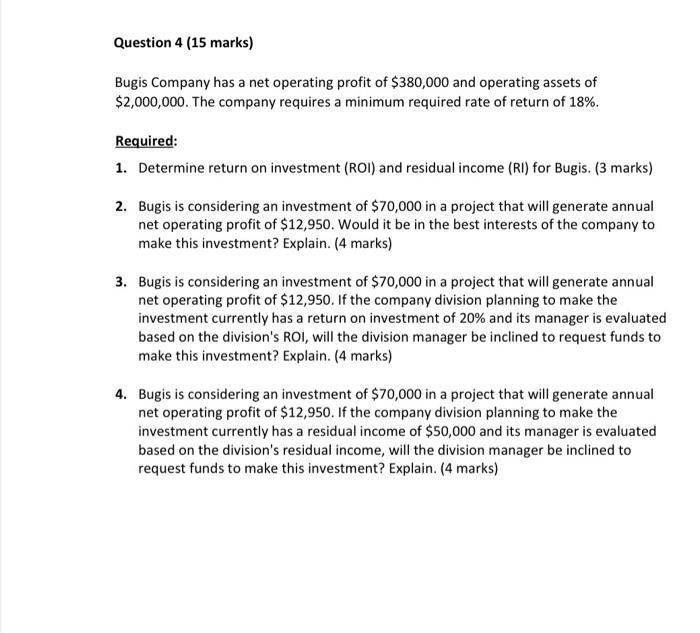

Question 4 (15 marks) Bugis Company has a net operating profit of $380,000 and operating assets of $2,000,000. The company requires a minimum required rate of return of 18%. Required: 1. Determine return on investment (ROI) and residual income (RI) for Bugis. (3 marks) 2. Bugis is considering an investment of $70,000 in a project that will generate annual net operating profit of $12,950. Would it be in the best interests of the company to make this investment? Explain. (4 marks) 3. Bugis is considering an investment of $70,000 in a project that will generate annual net operating profit of $12,950. If the company division planning to make the investment currently has a return on investment of 20% and its manager is evaluated based on the division's ROI, will the division manager be inclined to request funds to make this investment? Explain. (4 marks) 4. Bugis is considering an investment of $70,000 in a project that will generate annual net operating profit of $12,950. If the company division planning to make the investment currently has a residual income of $50,000 and its manager is evaluated based on the division's residual income, will the division manager be inclined to request funds to make this investment? Explain. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts