Question: QUESTION 4 (15 marks) Super Cleaner purchased an automatic dry cleaning machine for $104,000 on January 1, 2017. The estimated useful life of the cleaning

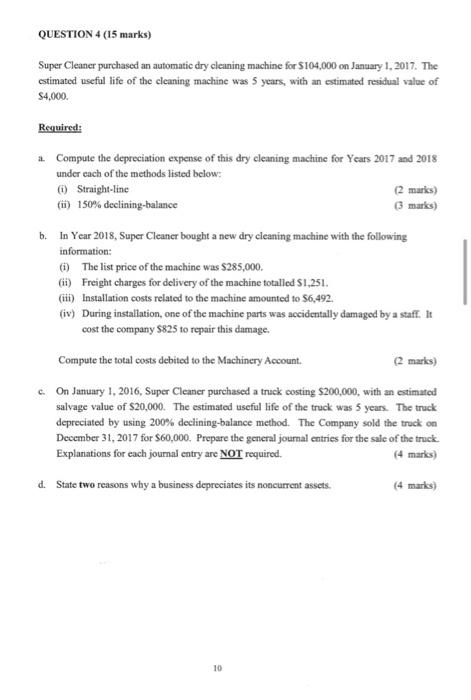

QUESTION 4 (15 marks) Super Cleaner purchased an automatic dry cleaning machine for $104,000 on January 1, 2017. The estimated useful life of the cleaning machine was 5 years, with an estimated residual value of $4.000 Required: a. Compute the depreciation expense of this dry cleaning machine for Ycars 2017 and 2018 under cach of the methods listed below: 6) Straight-line (2 marks) () 150% declining-balance (3 marks) b. In Year 2018, Super Cleaner bought a new dry cleaning machine with the following information: 1) The list price of the machine was $285,000. (ii) Freight charges for delivery of the machine totalled S1,251. (iii) Installation costs related to the machine amounted to 56,492. (iv) During installation, one of the machine parts was accidentally damaged by a staff. It cost the company $825 to repair this damage. Compute the total costs debited to the Machinery Account (2 marks) c. On January 1, 2016, Super Cleaner purchased a truck costing $200,000, with an estimated salvage value of $20,000. The estimated useful life of the truck was 5 years. The truck depreciated by using 200% declining-balance method. The Company sold the truck on December 31, 2017 for $60,000. Prepare the general journal entries for the sale of the truck Explanations for each journal entry are NOT required. (4 marks) d. State two reasons why a business depreciates its noncurrent assets. 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts