Question: Question 4 (15 marks) The table below contains prices, coupons and the time to maturity for three bonds. The bonds pay coupons annually and have

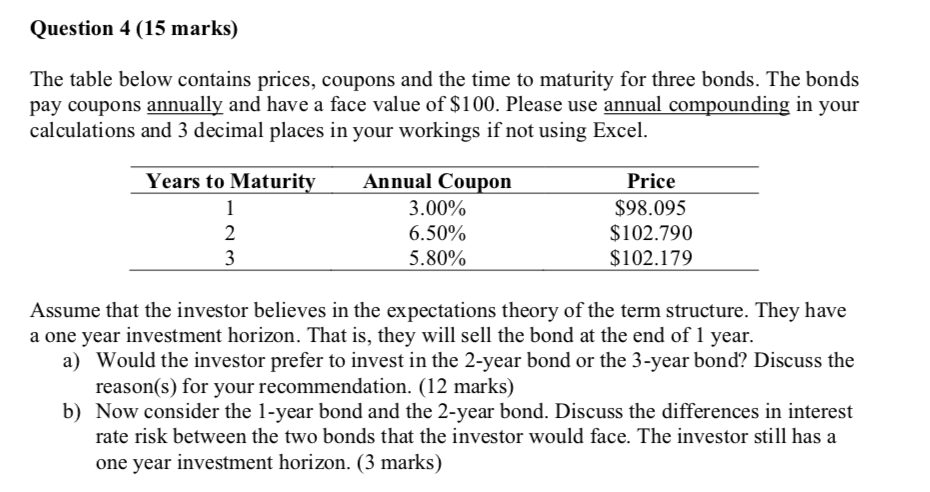

Question 4 (15 marks) The table below contains prices, coupons and the time to maturity for three bonds. The bonds pay coupons annually and have a face value of $100. Please use annual compounding in your calculations and 3 decimal places in your workings if not using Excel. Years to Maturity 1 2 3 Annual Coupon 3.00% 6.50% 5.80% Price $98.095 $102.790 $102.179 Assume that the investor believes in the expectations theory of the term structure. They have a one year investment horizon. That is, they will sell the bond at the end of 1 year. a) Would the investor prefer to invest in the 2-year bond or the 3-year bond? Discuss the reason(s) for your recommendation. (12 marks) b) Now consider the 1-year bond and the 2-year bond. Discuss the differences in interest rate risk between the two bonds that the investor would face. The investor still has a one year investment horizon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts