Question: Question 4 (1.5 points) Thomson Corp. provides a defined benefit pension plan for its employees, and uses IFRS to account for it. The corporation's actuary

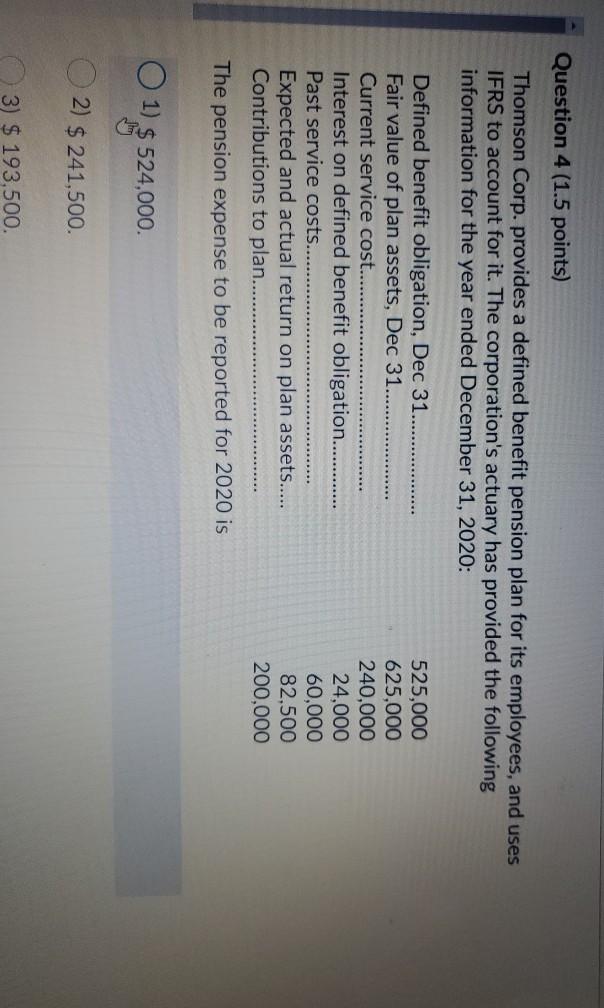

Question 4 (1.5 points) Thomson Corp. provides a defined benefit pension plan for its employees, and uses IFRS to account for it. The corporation's actuary has provided the following information for the year ended December 31, 2020: Defined benefit obligation, Dec 31.. Fair value of plan assets, Dec 31..... Current service cost... Interest on defined benefit obligation... Past service costs....... Expected and actual return on plan assets..... Contributions to plan..... The pension expense to be reported for 2020 is 525,000 625,000 240,000 24,000 60,000 82,500 200,000 O 1) $ 524,000. 2) $ 241,500. 3) $ 193,500

Step by Step Solution

There are 3 Steps involved in it

To calculate the pension expense under IFRS we need to consider the following components 1 Current ... View full answer

Get step-by-step solutions from verified subject matter experts