Question: Question 4 (16 marks) a) The expected return on Stock A and B are 10% per year and 18 % per year respectively. You wish

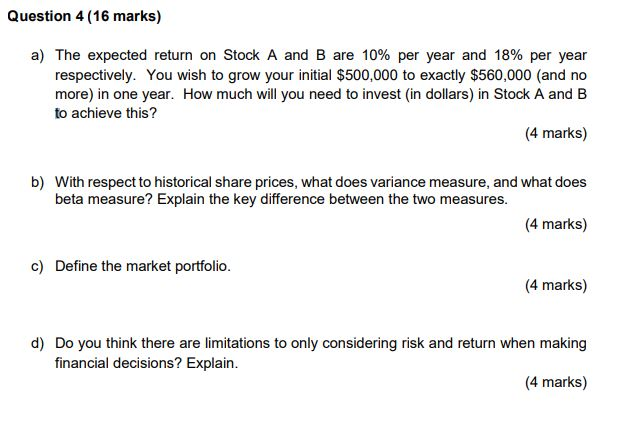

Question 4 (16 marks) a) The expected return on Stock A and B are 10% per year and 18 % per year respectively. You wish to grow your initial $500,000 to exactly $560,000 (and no more) in one year. How much will you need to invest (in dollars) in Stock A and B to achieve this? (4 marks) b) With respect to historical share prices, what does variance measure, and what does beta measure? Explain the key difference between the two measures. (4 marks) c) Define the market portfolio. (4 marks) d) Do you think there are limitations to only considering risk and return when making financial decisions? Explain (4 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock