Question: Question 4 (16 marks) Consider a two-period binomial market model for an underlying asset with price process Se at each time t. Branching from t

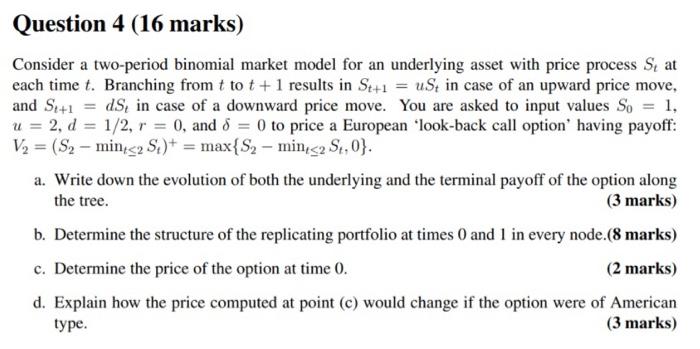

Question 4 (16 marks) Consider a two-period binomial market model for an underlying asset with price process Se at each time t. Branching from t to t +1 results in St+1 = ust in case of an upward price move, and Se+1 = ds, in case of a downward price move. You are asked to input values So = 1, u = 2, d = 1/2, r = 0, and 8 = 0 to price a European look-back call option' having payoff: V2 = (S2 - min

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts