Question: QUESTION 4 (18 MARKS) As a speculative trader you are interested in the performance of the KLCI. The last few months you observed the market

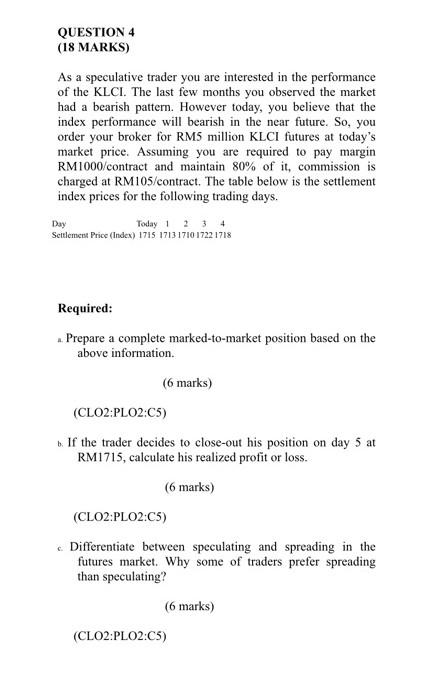

QUESTION 4 (18 MARKS) As a speculative trader you are interested in the performance of the KLCI. The last few months you observed the market had a bearish pattern. However today, you believe that the index performance will bearish in the near future. So, you order your broker for RM5 million KLCI futures at today's market price. Assuming you are required to pay margin RM1000/contract and maintain 80% of it, commission is charged at RM105/contract. The table below is the settlement index prices for the following trading days. Day Today 1 2 3 4 Settlement Price (Index) 1715 1713 1710 1722 1718 Required: A. a. Prepare a complete marked-to-market position based on the above information. (6 marks) (CLO2:PLO2:C5) b. If the trader decides to close-out his position on day 5 at RM1715, calculate his realized profit or loss. (6 marks) (CLO2:PLO2:C5) Differentiate between speculating and spreading in the futures market. Why some of traders prefer spreading than speculating? (6 marks) (CLO2:PLO2:C5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts