Question: QUESTION 4 (18 marks) Peter is 35 years old and will retire at age 65. He will receive retirement benefits but the benefits are not

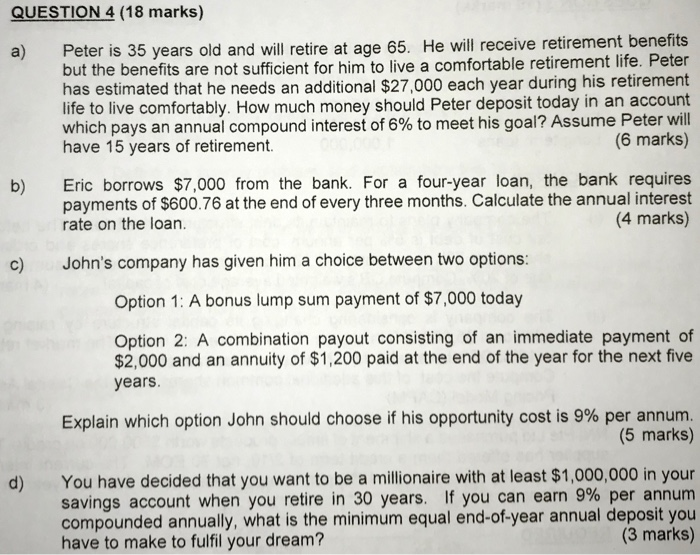

QUESTION 4 (18 marks) Peter is 35 years old and will retire at age 65. He will receive retirement benefits but the benefits are not sufficient for him to live a comfortable retirement life. Peter has estimated that he needs an additional $27,000 each year during his retirement life to live comfortably. How much money should Peter deposit today in an account which pays an annual compound interest of 6% to meet his goal? Assume Peter will a) have 15 years of retirement. (6 marks) Eric borrows $7,000 from the bank. For a four-year loan, the bank requires payments of $600.76 at the end of every three months. Calculate the annual interest (4 marks) b) rate on the loan. c) John's company has given him a choice between two options Option 1: A bonus lump sum payment of $7,000 today Option 2: A combination payout consisting of an immediate payment of $2,000 and an annuity of $1,200 paid at the end of the year for the next five years Explain which option John should choose if his opportunity cost is 9% per annum. (5 marks) d) You have decided that you want to be a millionaire with at least $1,000,000 in your savings account when you retire in 30 years. If you can earn 9% per annum compounded annually, what is the minimum equal end-of-year annual deposit you (3 marks) have to make to fulfil your dream

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts