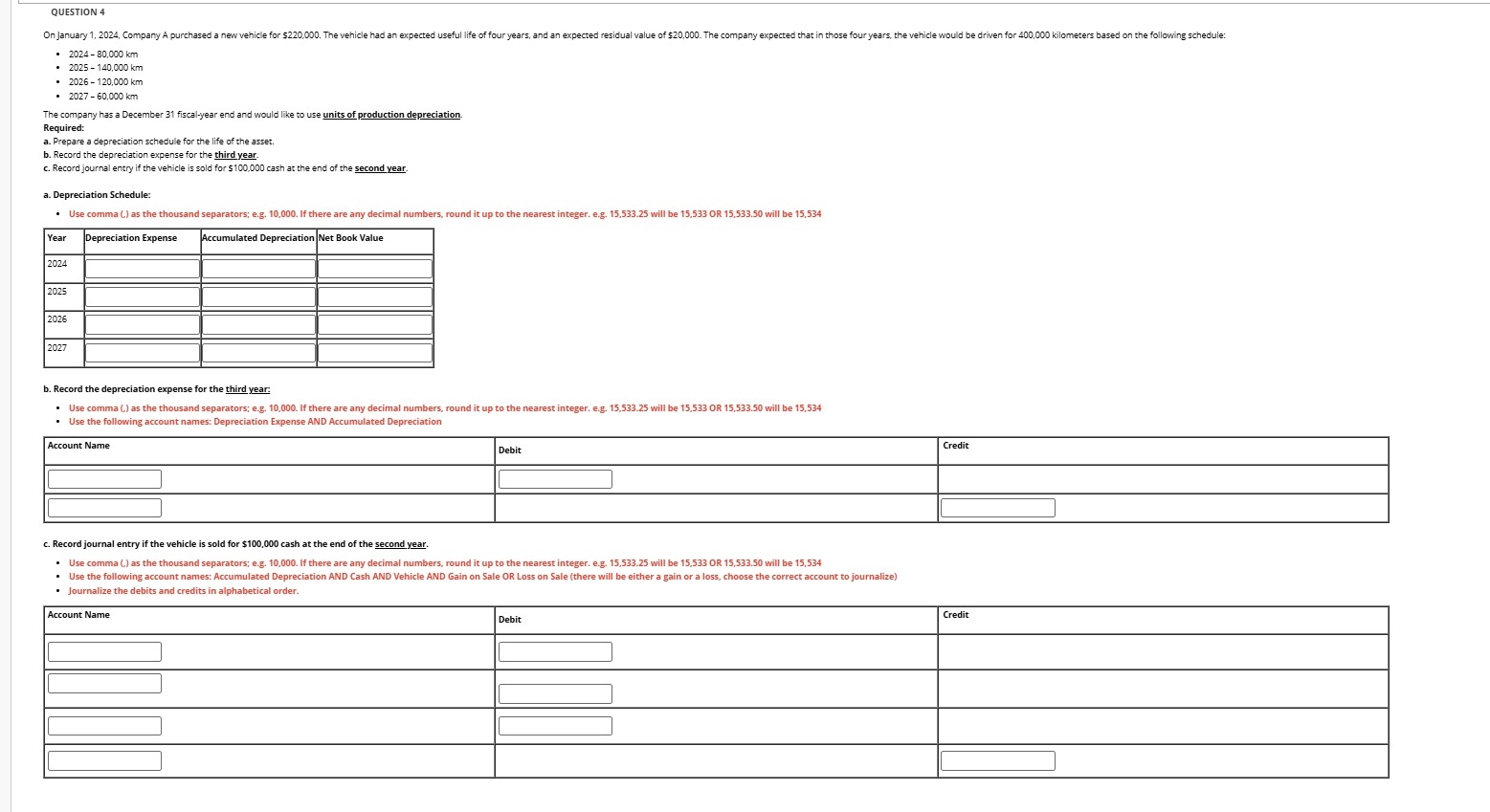

Question: QUESTION 4 2 0 2 4 - 8 0 , 0 0 0 k m 2 0 2 5 - 1 4 0 , 0

QUESTION

km

The company has a December fiscalyear end and would like to use units of production depreciation. Required:

a Prepare a depreciation schedule for the life of the asset.

b Record the depreciation expense for the third year.

c Record journal entry if the vehicle is sold for $ cash at the end of the second year

a Depreciation Schedule:

Use comma as the thousand separators; eg If there are any decimal numbers, round it up to the nearest integer. eg will be oR will be

tableYearDepreciation Expense,Accumulated Depreciation,Net Book Value

b Record the depreciation expense for the third year:

Use comma as the thousand separators; eg If there are any decimal numbers, round it up to the nearest integer. eg will be OR will be

Use the following account names: Depreciation Expense AND Accumulated Depreciation

tableAccount Name,Debit,Credit

c Record journal entry if the vehicle is sold for $ cash at the end of the second year.

Use comma as the thousand separators; eg If there are any decimal numbers, round it up to the nearest integer. eg will be OR will be

Use the following account names: Accumulated Depreciation AND Cash AND Vehicle AND Gain on Sale OR Loss on Sale there will be either a gain or a loss, choose the correct account to journalize

Journalize the debits and credits in alphabetical order.

tableAccount Name,Debit,Credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock