Question: Question 4 ( 2 0 Marks ) In preparing your Budget and Cash Flow for the year ending 3 0 June 2 0 2 6

Question Marks

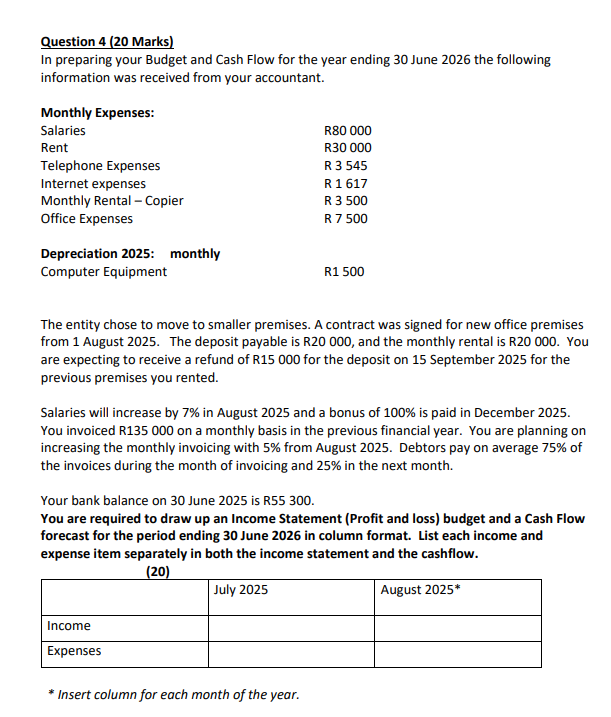

In preparing your Budget and Cash Flow for the year ending June the following information was received from your accountant.

Monthly Expenses:

Depreciation : monthly

Computer Equipment R

The entity chose to move to smaller premises. A contract was signed for new office premises from August The deposit payable is R and the monthly rental is R You are expecting to receive a refund of R for the deposit on September for the previous premises you rented.

Salaries will increase by in August and a bonus of is paid in December You invoiced R on a monthly basis in the previous financial year. You are planning on increasing the monthly invoicing with from August Debtors pay on average of the invoices during the month of invoicing and in the next month.

Your bank balance on June is R

You are required to draw up an Income Statement Profit and loss budget and a Cash Flow forecast for the period ending June in column format. List each income and expense item separately in both the income statement and the cashflow.

Insert column for each month of the year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock