Question: QUESTION 4 ( 2 0 Marks ) REQUIRED Use the information given below to prepare the following for the first three months of operations (

QUESTION

Marks

REQUIRED

Use the information given below to prepare the following for the first three months of operations ie January, February and March :

Debtors Collection Schedule

marks

Cash Budget

marks

INFORMATION

The following information relates to Crompton Manufacturers which will commence business on January with a capital contribution of R cash:

A loan of R is expected to be obtained from Len Bank on at the start of January A repayment of R per month plus interest at a rate of per year will be paid at the end of each month, commencing January

New machinery and equipment will be purchased on January for R A deposit of will be paid immediately. The balance of the debt as well as finance charges of R will be paid in equal monthly instalments commencing February

Estimated production and sales are as follows:

tableProduction unitsSales unitsJanuaryFebruaryMarchApril

The sales price will be set at R per unit. Cash sales are expected to comprise of the total sales. A cash discount of will be granted to these customers. The balance of the sales will be on credit. Thirty percent of the amount owing is expected to be received in the month of the sale and a discount of will be granted to these customers. The balance is expected to be collected the month after the sale.

Variable manufacturing costs per unit are forecast as follows:

Direct materials will be purchased on credit to meet the production requirements of each month. Creditors are expected to be paid in the month after the purchase.

Direct labour costs are settled monthly.

Variable manufacturing overheads will be paid in the month in which they are incurred.

Fixed costs amount to R per month excluding depreciation of R per month and are paid monthly.

:

OSA Nov.pdf

QUESTION

Marks

REQUIRED

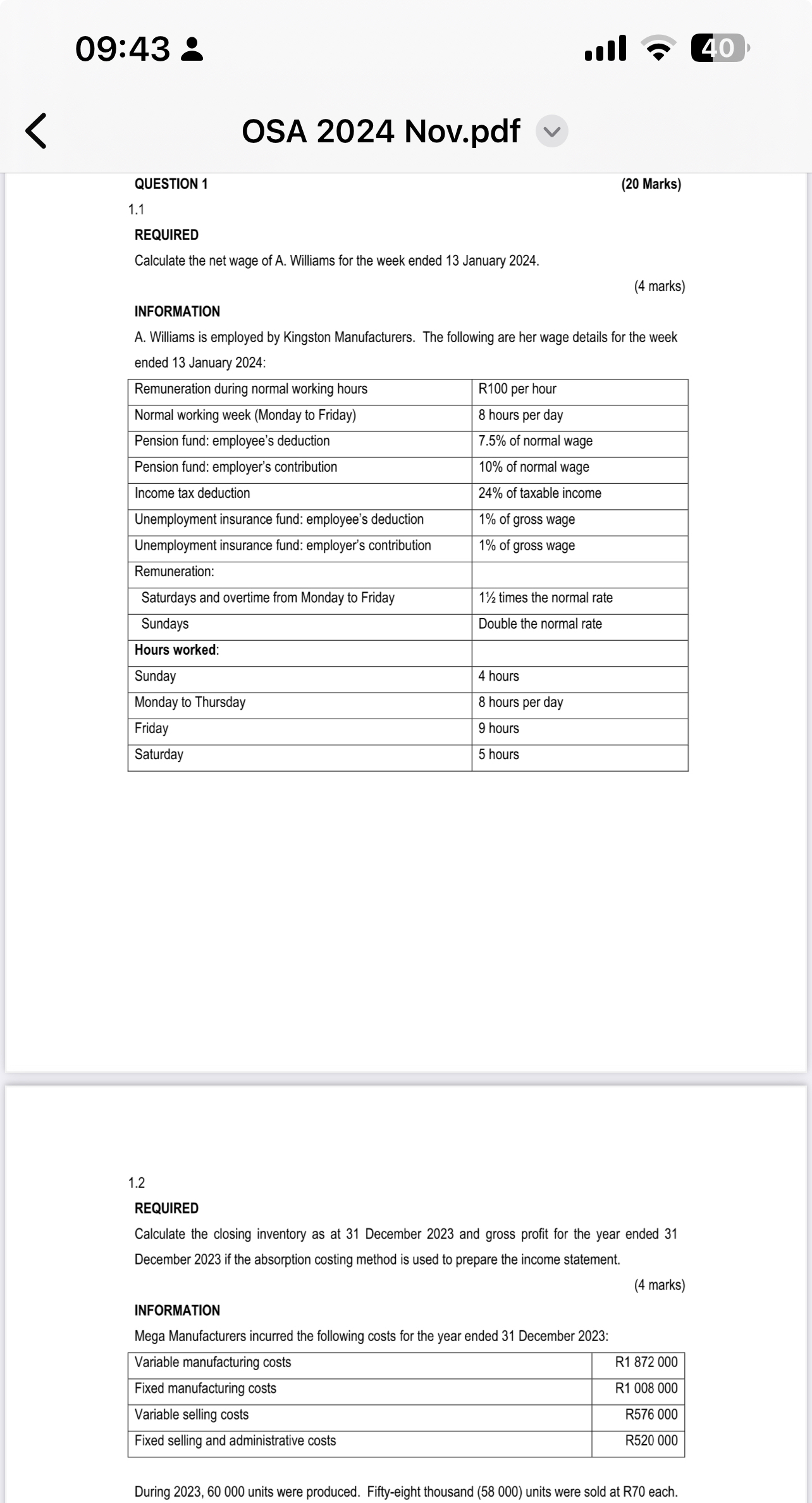

Calculate the net wage of A Williams for the week ended January

marks

INFORMATION

A Williams is employed by Kingston Manufacturers. The following are her wage details for the week ended January :

tableRemuneration during normal working hours,R per hourNormal working week Monday to Friday hours per dayPension fund: employee's deduction, of normal wagePension fund: employer's contribution, of normal wageIncome tax deduction, of taxable incomeUnemployment insurance fund: employee's deduction, of gross wageUnemployment insurance fund: employer's contribution, of gross wageRemuneration:Saturdays and overtime from Monday to Friday, times the normal rateSundaysDouble the normal rateHours worked:,Sunday hoursMonday to Thursday, hours per dayFriday hoursSaturday hours

REQUIRED

Calculate the closing inventory as at December and gross profit for the year ended December if the absorption costing method is used to prepare the income statement.

marks

INFORMATION

Mega Manufacturers incurred the following costs for the year ended December :

tableVariable manufacturing costs,RFixed manufacturing costs,RVariable selling costs,RFixed selling and administrative costs,R

During units were produced. Fiftyeight thousand units were sold at R each.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock