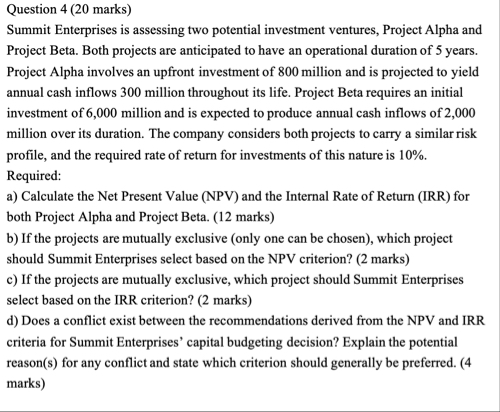

Question: Question 4 ( 2 0 marks ) Summit Enterprises is assessing two potential investment ventures, Project Alpha and Project Beta. Both projects are anticipated to

Question marks

Summit Enterprises is assessing two potential investment ventures, Project Alpha and Project Beta. Both projects are anticipated to have an operational duration of years.

Project Alpha involves an upfront investment of million and is projected to yield annual cash inflows million throughout its life. Project Beta requires an initial investment of million and is expected to produce annual cash inflows of million over its duration. The company considers both projects to carry a similar risk profile, and the required rate of return for investments of this nature is

Required:

a Calculate the Net Present Value NPV and the Internal Rate of Return IRR for both Project Alpha and Project Beta. marks

b If the projects are mutually exclusive only one can be chosen which project should Summit Enterprises select based on the NPV criterion? marks

c If the projects are mutually exclusive, which project should Summit Enterprises select based on the IRR criterion? marks

d Does a conflict exist between the recommendations derived from the NPV and IRR criteria for Summit Enterprises' capital budgeting decision? Explain the potential reasons for any conflict and state which criterion should generally be preferred. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock