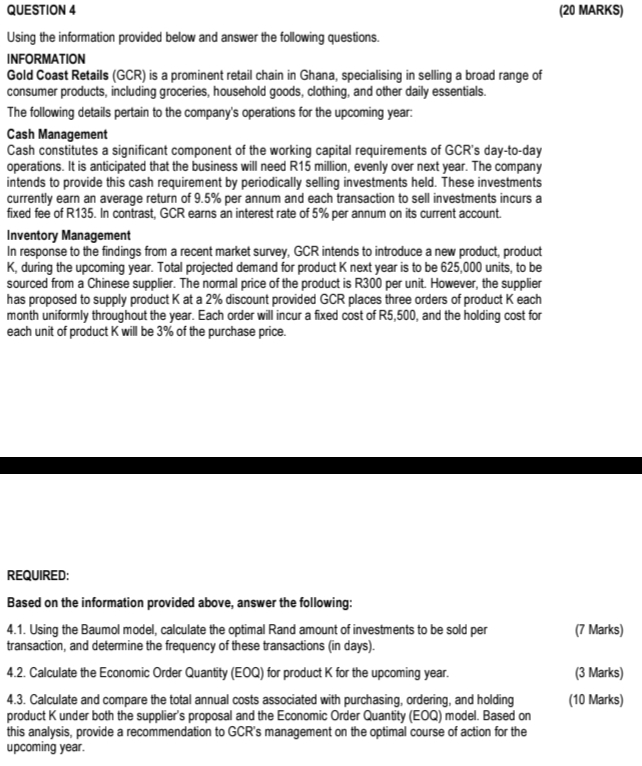

Question: QUESTION 4 ( 2 0 MARKS ) Using the information provided below and answer the following questions. INFORMATION Gold Coast Retails ( GCR ) is

QUESTION

MARKS

Using the information provided below and answer the following questions.

INFORMATION

Gold Coast Retails GCR is a prominent retail chain in Ghana, specialising in selling a broad range of consumer products, including groceries, household goods, clothing, and other daily essentials.

The following details pertain to the company's operations for the upcoming year:

Cash Management

Cash constitutes a significant component of the working capital requirements of GCRs daytoday operations. It is anticipated that the business will need R million, evenly over next year. The company intends to provide this cash requirement by periodically selling investments held. These investments currently earn an average return of per annum and each transaction to sell investments incurs a fixed fee of R In contrast, GCR earns an interest rate of per annum on its current account.

Inventory Management

In response to the findings from a recent market survey, GCR intends to introduce a new product, product K during the upcoming year. Total projected demand for product K next year is to be units, to be sourced from a Chinese supplier. The normal price of the product is R per unit. However, the supplier has proposed to supply product K at a discount provided GCR places three orders of product K each month uniformly throughout the year. Each order will incur a fixed cost of R and the holding cost for each unit of product K will be of the purchase price.

REQUIRED:

Based on the information provided above, answer the following:

Using the Baumol model, calculate the optimal Rand amount of investments to be sold per

Marks transaction, and determine the frequency of these transactions in days

Calculate the Economic Order Quantity EOQ for product K for the upcoming year.

Marks

Calculate and compare the total annual costs associated with purchasing, ordering, and holding

Marks product K under both the supplier's proposal and the Economic Order Quantity EOQ model. Based on this analysis, provide a recommendation to GCRs management on the optimal course of action for the upcoming year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock