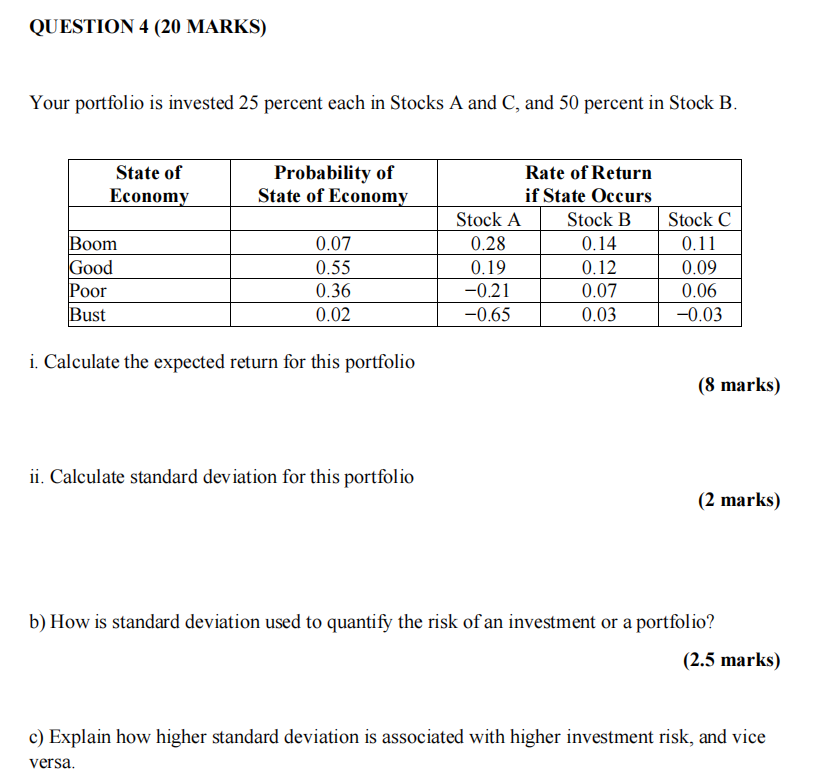

Question: QUESTION 4 ( 2 0 MARKS ) Your portfolio is invested 2 5 percent each in Stocks A and C , and 5 0 percent

QUESTION MARKS

Your portfolio is invested percent each in Stocks A and C and percent in Stock B

i Calculate the expected return for this portfolio

ii Calculate standard deviation for this portfolio

b How is standard deviation used to quantify the risk of an investment or a portfolio?

marks

c Explain how higher standard deviation is associated with higher investment risk, and vice versa.

d The common stock of Alpha Manufacturers has a beta of and an actual expected return of percent. The riskfree rate of return is percent and the market rate of return is percent. Calculate the current position of this stock overpriced or underpriced

marks

e Explain the concept of the Security Market Line SML and its significance in modern portfolio theory.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock