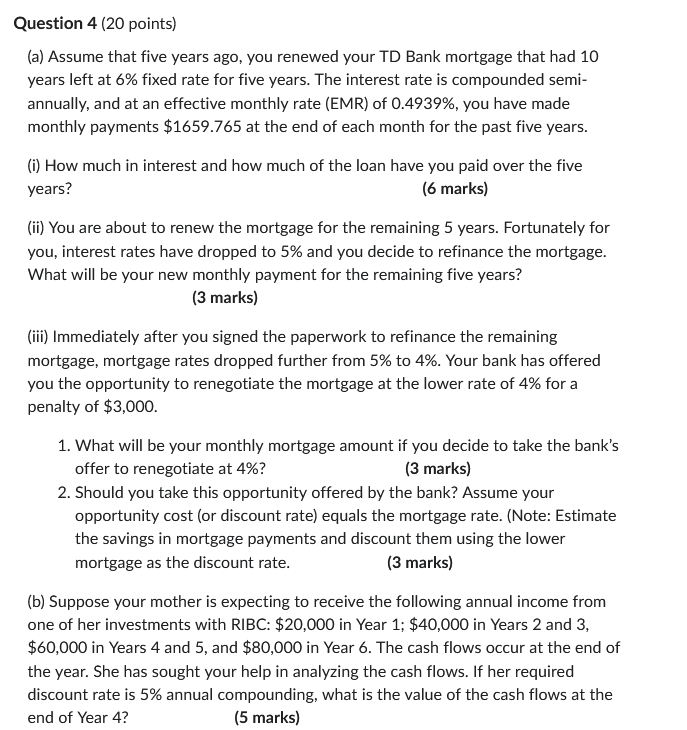

Question: Question 4 ( 2 0 points ) ( a ) Assume that five years ago, you renewed your TD Bank mortgage that had 1 0

Question points

a Assume that five years ago, you renewed your TD Bank mortgage that had

years left at fixed rate for five years. The interest rate is compounded semi

annually, and at an effective monthly rate EMR of you have made

monthly payments $ at the end of each month for the past five years.

i How much in interest and how much of the loan have you paid over the five

years?

marks

ii You are about to renew the mortgage for the remaining years. Fortunately for

you, interest rates have dropped to and you decide to refinance the mortgage.

What will be your new monthly payment for the remaining five years?

marks

iii Immediately after you signed the paperwork to refinance the remaining

mortgage, mortgage rates dropped further from to Your bank has offered

you the opportunity to renegotiate the mortgage at the lower rate of for a

penalty of $

What will be your monthly mortgage amount if you decide to take the bank's

offer to renegotiate at

marks

Should you take this opportunity offered by the bank? Assume your

opportunity cost or discount rate equals the mortgage rate. Note: Estimate

the savings in mortgage payments and discount them using the lower

mortgage as the discount rate.

marks

b Suppose your mother is expecting to receive the following annual income from

one of her investments with RIBC: $ in Year ; $ in Years and

$ in Years and and $ in Year The cash flows occur at the end of

the year. She has sought your help in analyzing the cash flows. If her required

discount rate is annual compounding, what is the value of the cash flows at the

end of Year

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock