Question: QUESTION 4 ( 2 1 marks ) Sharp Innovations ( Pty ) Ltd ( Sharp Innovations ) is evaluating the purchase of a new

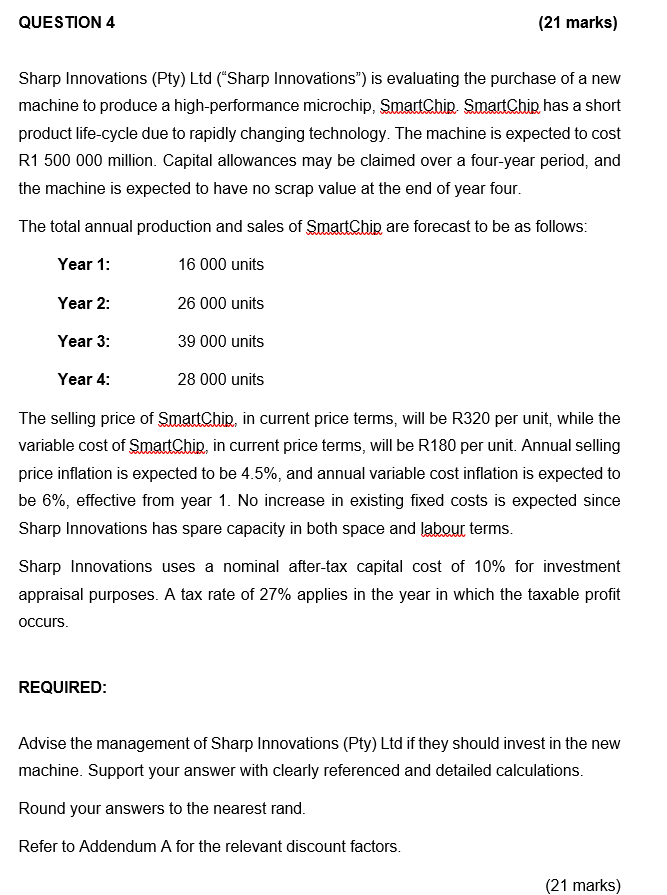

QUESTION marks Sharp Innovations Pty Ltd Sharp Innovations" is evaluating the purchase of a new machine to produce a highperformance microchip, SmartChip. SmartChip has a short product lifecycle due to rapidly changing technology. The machine is expected to cost R million. Capital allowances may be claimed over a fouryear period, and the machine is expected to have no scrap value at the end of year four. The total annual production and sales of SmartChip are forecast to be as follows: The selling price of SmartChip, in current price terms, will be R per unit, while the variable cost of SmartCbip, in current price terms, will be R per unit. Annual selling price inflation is expected to be and annual variable cost inflation is expected to be effective from year No increase in existing fixed costs is expected since Sharp Innovations has spare capacity in both space and labour terms. Sharp Innovations uses a nominal aftertax capital cost of for investment appraisal purposes. A tax rate of applies in the year in which the taxable profit occurs. REQUIRED: Advise the management of Sharp Innovations Pty Ltd if they should invest in the new machine. Support your answer with clearly referenced and detailed calculations. Round your answers to the nearest rand. Refer to Addendum A for the relevant discount factors.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock