Question: QUESTION 4 ( 2 5 marks ) Walker ( Pty ) Ltd ( Walker ) is a company that manufactures kitchen cupboards. Walker has a

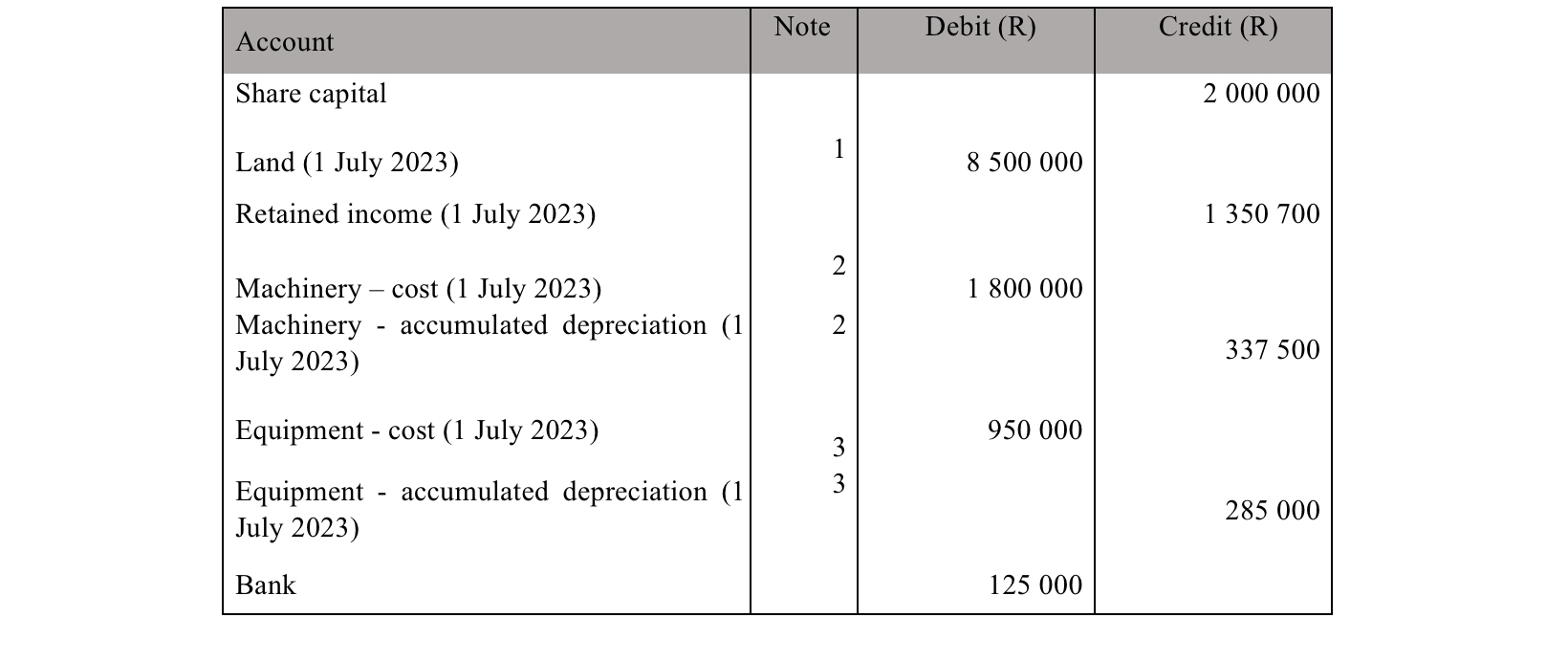

QUESTION marks Walker Pty Ltd Walker is a company that manufactures kitchen cupboards. Walker has a June financial yearend. Account Note Debit R Credit R Share capital Land July Retained income July Machinery cost July Machinery accumulated depreciation July Equipment cost July Equipment accumulated depreciation July Bank The following transactions took place during the current financial year and have not yet been recorded: Note : Land: On January Walker received the valuation report from the bank, stating that the land is worth R The land was purchased on January Note : Machinery: Machinery consists of machine that is used to cut the material in the shape that is required. This machine consists of components, namely mechanical and control. The mechanical component contributes to of the total cost of the machinery and the balance of of the total cost is attributable to the control component. The mechanical component has a useful life of years, and the control component only has a useful life of years and are depreciated on the straightline method. The machine was purchased and ready for use on the st of January Components: Mechanical Control Component contribution: Useful life: years years Purchase date: January January On the st of May the control component of the machine broke and needed to be replaced. The component was relaced immediately at a cost of R The component was ready for use on the st of May Walker paid the supplier at the end of the month as agreed. The new control component has a useful life of years and is depreciated on the straightline method. Note : Equipment: Equipment consists of drills. All the drills have been purchased on the st of January All drills were available for use on the st of January These drills have a useful life of years and are depreciated on the straightline method. On the st of November Walker had to service all the drills at a cost of R They paid the service provider immediately in cash. Additional information: Walker is not a registered VAT vendor. Land is accounted for on the revaluation model. Exclude all income and deferred taxation implications.

tableAccountNote,Debit RCredit RShare capital,,,Land July Retained income July Machinery cost July tableMachinery accumulated depreciation July Equipment cost July tableEquipment accumulated depreciation July BankREQUIRED: By referring to notes and prepare the general journal entries to account for transactions related to land and equipment in the accounting records of Walker Pty Ltd for the year ended June Journal dates and narrations are not required. marks By referring to note calculate the depreciation expense for the machinery for the year ended June marks Prepare an extract of the Statement of Financial Position of Walker Pty Ltd showing only the Noncurrent Assets of Walker Ltd for the year ended June Totals are not required. Round off to the nearest Rand where applicable. Reference all workings including those from

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock