Question: Question 4 (2 Points) Buy October 165 put contract. Hold it until the option expires. Determine the profits and graph the results. Identify the breakeven

Question 4 (2 Points) Buy October 165 put contract. Hold it until the option expires. Determine the profits and graph the results. Identify the breakeven stock price at expiration. What is the maximum gain and loss on this transaction?

Question 5 (2 Points) Buy 100 shares of stock and write one October 170 call contract. Hold the position until expiration. Determine the profits and graph the results. Identify the breakeven stock price at expiration, the maximum profits, and the maximum loss.

Question 6 (2 points) Buy 100 shares of stock and buy one August 165 put contract. Hold the position until expiration. Determine the profits and graph the results. Determine the breakeven stock price at expiration, the maximum profit, and the maximum loss.

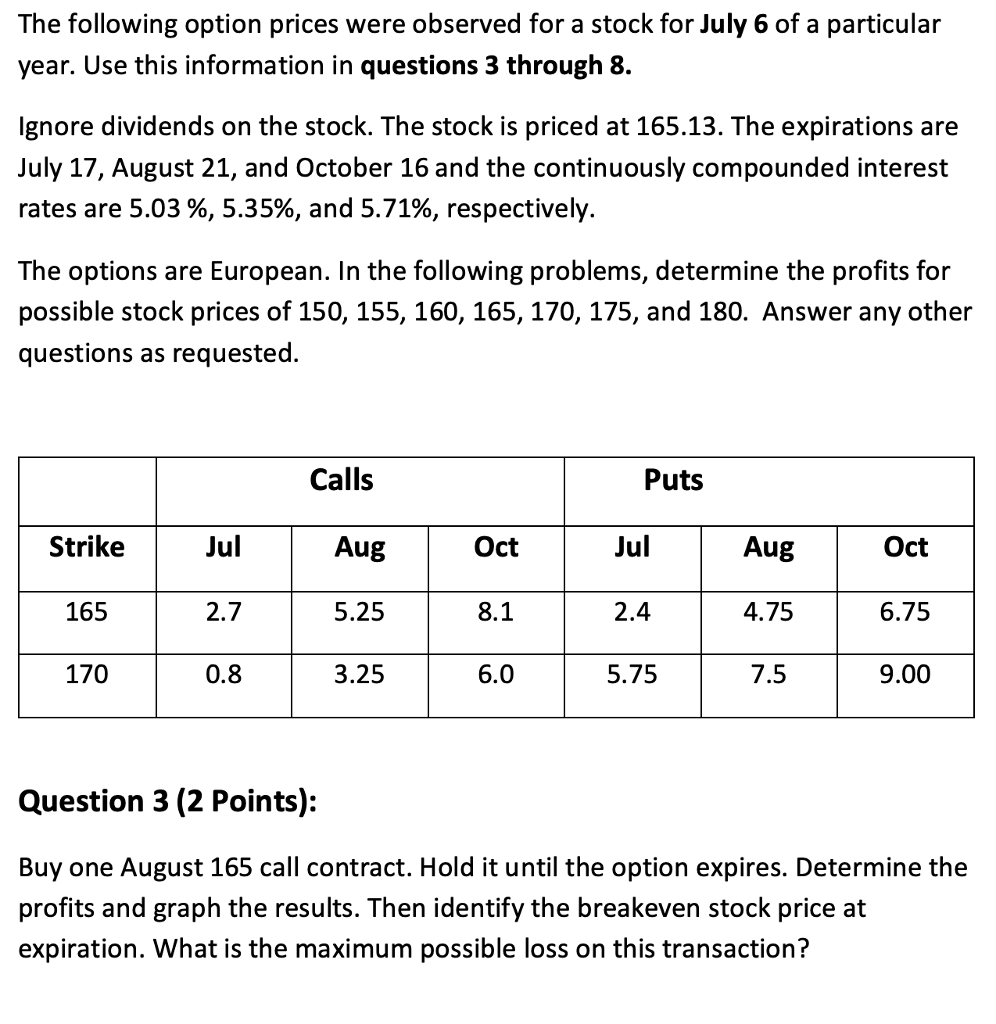

The following option prices were observed for a stock for July 6 of a particular year. Use this information in questions 3 through 8. lgnore dividends on the stock. The stock is priced at 165.13. The expirations are July 17, August 21, and October 16 and the continuously compounded interest rates are 5.03 %, 5.35%, and 5.71%, respectively. The options are European. In the following problems, determine the profits for possible stock prices of 150, 155, 160, 165, 170, 175, and 180. Answer any other questions as requested. Strike 165 170 Jul 2.7 0.8 Calls Aug 5.25 3.25 Oct 8.1 6.0 Puts Jul 2.4 5.75 Aug 4.75 7.5 Oct 6.75 9.00 Question 3 (2 Points): Buy one August 165 call contract. Hold it until the option expires. Determine the profits and graph the results. Then identify the breakeven stock price at expiration. What is the maximum possible loss on this transaction? The following option prices were observed for a stock for July 6 of a particular year. Use this information in questions 3 through 8. lgnore dividends on the stock. The stock is priced at 165.13. The expirations are July 17, August 21, and October 16 and the continuously compounded interest rates are 5.03 %, 5.35%, and 5.71%, respectively. The options are European. In the following problems, determine the profits for possible stock prices of 150, 155, 160, 165, 170, 175, and 180. Answer any other questions as requested. Strike 165 170 Jul 2.7 0.8 Calls Aug 5.25 3.25 Oct 8.1 6.0 Puts Jul 2.4 5.75 Aug 4.75 7.5 Oct 6.75 9.00 Question 3 (2 Points): Buy one August 165 call contract. Hold it until the option expires. Determine the profits and graph the results. Then identify the breakeven stock price at expiration. What is the maximum possible loss on this transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts