Question: Question 4 (2 points) Katie and Tom are planning on having a family, and our looking to buy a house in Tallahassee, FL. Tom currently

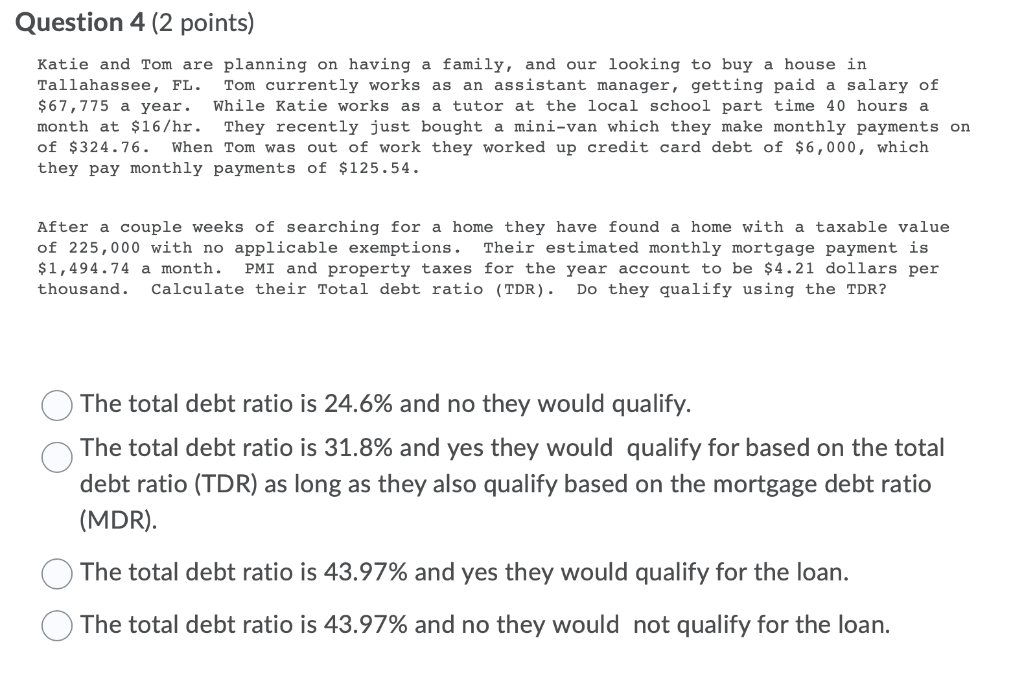

Question 4 (2 points) Katie and Tom are planning on having a family, and our looking to buy a house in Tallahassee, FL. Tom currently works as an assistant manager, getting paid a salary of $67,775 a year. While Katie works as a tutor at the local school part time 40 hours a month at $16/hr. They recently just bought a mini-van which they make monthly payments on of $324.76. When Tom was out of work they worked up credit card debt of $6,000, which they pay monthly payments of $125.54. After a couple weeks of searching for a home they have found a home with a taxable value of 225,000 with no applicable exemptions. Their estimated monthly mortgage payment is $1,494.74 a month. PMI and property taxes for the year account to be $4.21 dollars per thousand. Calculate their Total debt ratio (TDR). Do they qualify using the TDR? The total debt ratio is 24.6% and no they would qualify. The total debt ratio is 31.8% and yes they would qualify for based on the total debt ratio (TDR) as long as they also qualify based on the mortgage debt ratio (MDR). The total debt ratio is 43.97% and yes they would qualify for the loan. The total debt ratio is 43.97% and no they would not qualify for the loan. Question 4 (2 points) Katie and Tom are planning on having a family, and our looking to buy a house in Tallahassee, FL. Tom currently works as an assistant manager, getting paid a salary of $67,775 a year. While Katie works as a tutor at the local school part time 40 hours a month at $16/hr. They recently just bought a mini-van which they make monthly payments on of $324.76. When Tom was out of work they worked up credit card debt of $6,000, which they pay monthly payments of $125.54. After a couple weeks of searching for a home they have found a home with a taxable value of 225,000 with no applicable exemptions. Their estimated monthly mortgage payment is $1,494.74 a month. PMI and property taxes for the year account to be $4.21 dollars per thousand. Calculate their Total debt ratio (TDR). Do they qualify using the TDR? The total debt ratio is 24.6% and no they would qualify. The total debt ratio is 31.8% and yes they would qualify for based on the total debt ratio (TDR) as long as they also qualify based on the mortgage debt ratio (MDR). The total debt ratio is 43.97% and yes they would qualify for the loan. The total debt ratio is 43.97% and no they would not qualify for the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts