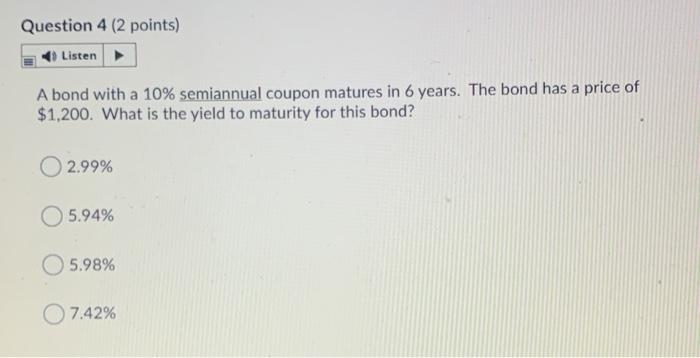

Question: Question 4 (2 points) Listen A bond with a 10% semiannual coupon matures in 6 years. The bond has a price of $1,200. What is

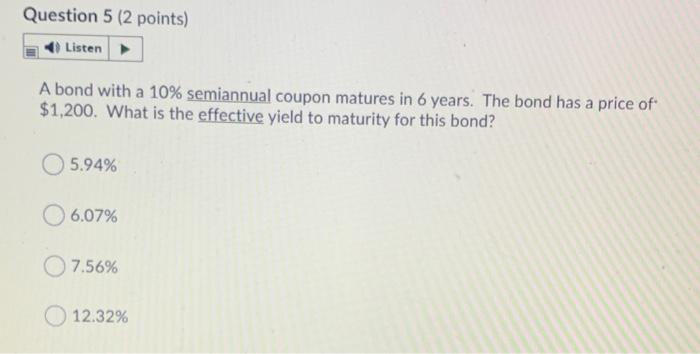

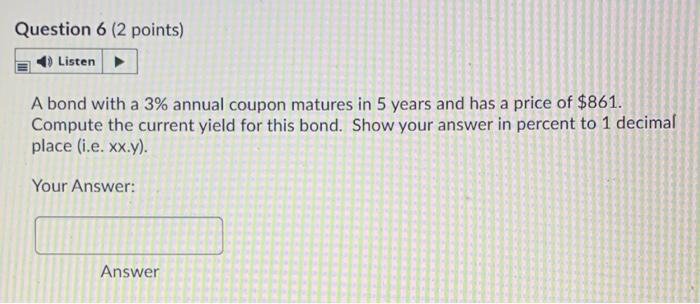

Question 4 (2 points) Listen A bond with a 10% semiannual coupon matures in 6 years. The bond has a price of $1,200. What is the yield to maturity for this bond? O2.99% 5.94% 5.98% 7.42% Question 5 (2 points) Listen A bond with a 10% semiannual coupon matures in 6 years. The bond has a price of $1,200. What is the effective yield to maturity for this bond? 5.94% 6.07% 7.56% 12.32% Question 6 (2 points) Listen A bond with a 3% annual coupon matures in 5 years and has a price of $861. Compute the current yield for this bond. Show your answer in percent to 1 decimal place (i.e. xx.y). Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts