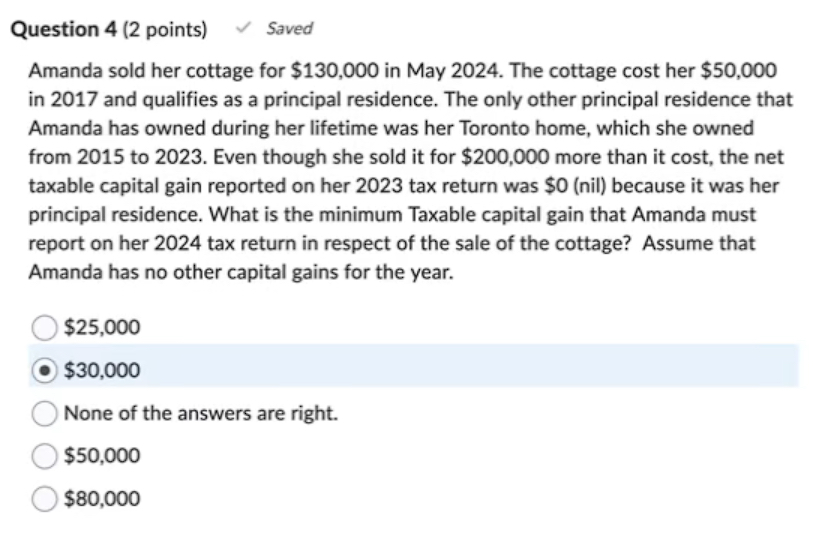

Question: Question 4 ( 2 points ) Saved Amanda sold her cottage for $ 1 3 0 , 0 0 0 in May 2 0 2

Question points

Saved

Amanda sold her cottage for $ in May The cottage cost her $ in and qualifies as a principal residence. The only other principal residence that Amanda has owned during her lifetime was her Toronto home, which she owned from to Even though she sold it for $ more than it cost the net taxable capital gain reported on her tax return was $nil because it was her principal residence. What is the minimum Taxable capital gain that Amanda must report on her tax return in respect of the sale of the cottage Assume that Amanda has no other capital gains for the year.

$

$

None of the answers are right.

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock