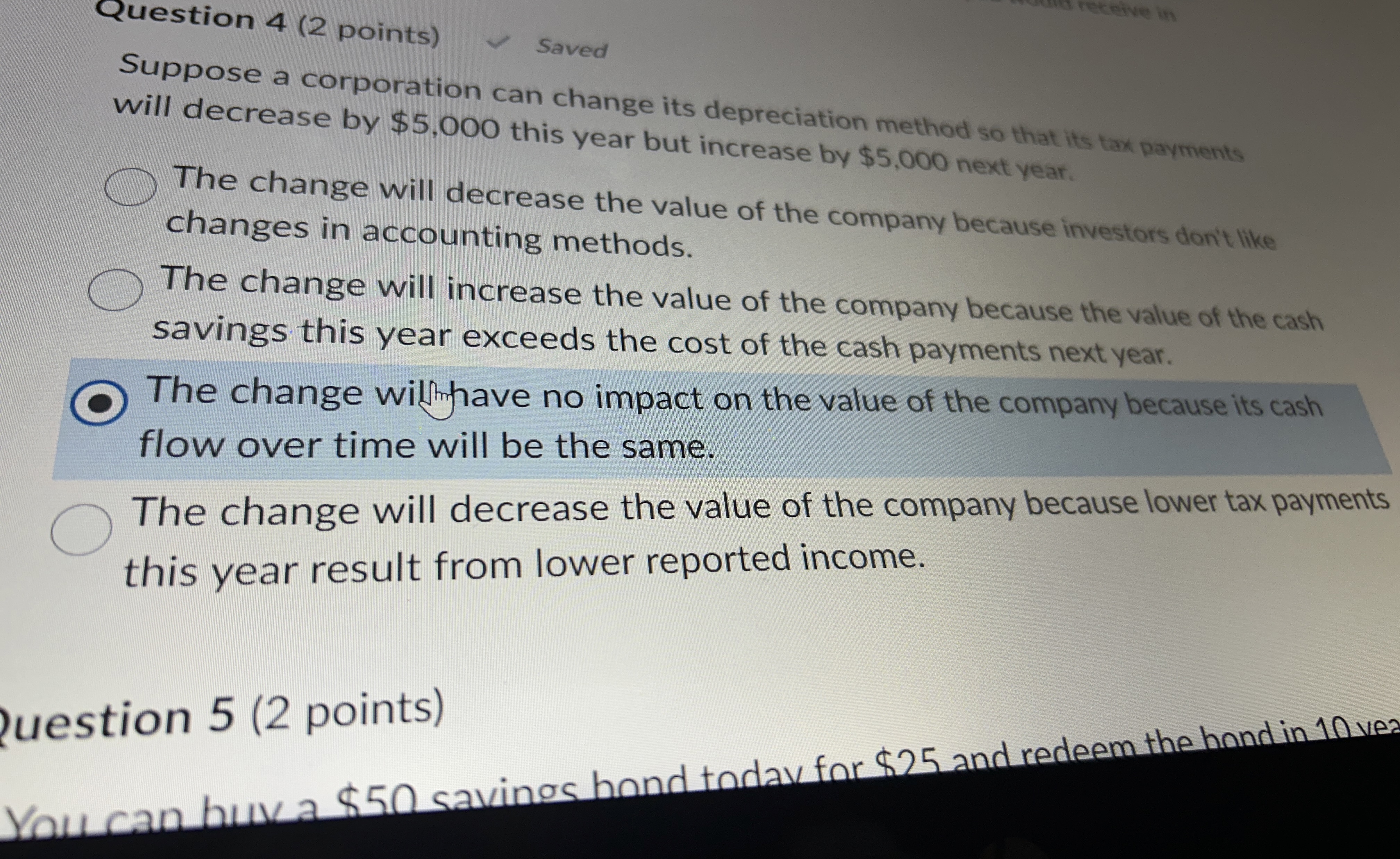

Question: Question 4 ( 2 points ) Saved Suppose a corporation can change its depreciation method so that its tax payments will decrease by $ 5

Question points

Saved

Suppose a corporation can change its depreciation method so that its tax payments will decrease by $ this year but increase by $ next year.

The change will decrease the value of the company because investors don't like changes in accounting methods.

The change will increase the value of the company because the value of the cash savings this year exceeds the cost of the cash payments next year.

The change willngave no impact on the value of the company because its cash flow over time will be the same.

The change will decrease the value of the company because lower tax payments this year result from lower reported income.

question points

You can buve $ cavings hond today for $ and redeem the hond in ves

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock