Question: Question 4 2 pts Pelican LLC, a technology startup was formed by Sophie and Linda, both of whom materially participate in the business. Pelican, LLC

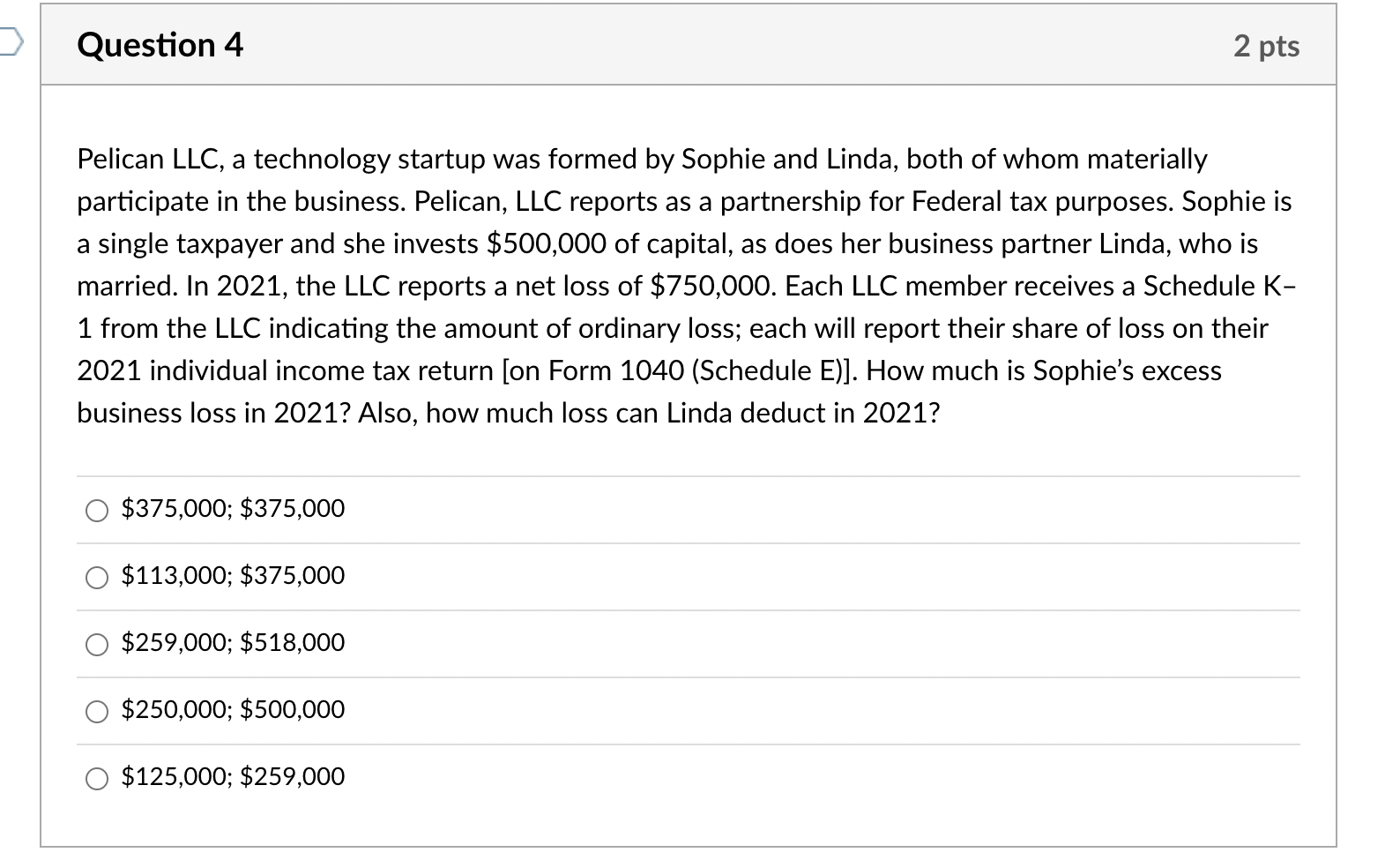

Question 4 2 pts Pelican LLC, a technology startup was formed by Sophie and Linda, both of whom materially participate in the business. Pelican, LLC reports as a partnership for Federal tax purposes. Sophie is a single taxpayer and she invests $500,000 of capital, as does her business partner Linda, who is married. In 2021, the LLC reports a net loss of $750,000. Each LLC member receives a Schedule K- 1 from the LLC indicating the amount of ordinary loss; each will report their share of loss on their 2021 individual income tax return (on Form 1040 (Schedule E)]. How much is Sophie's excess business loss in 2021? Also, how much loss can Linda deduct in 2021? $375,000; $375,000 $113,000; $375,000 $259,000; $518,000 $250,000; $500,000 O $125,000; $259,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts