Question: Question 4 2 pts You would like to create a portfolio that is equally invested in a risk-free asset and two stocks. One stock has

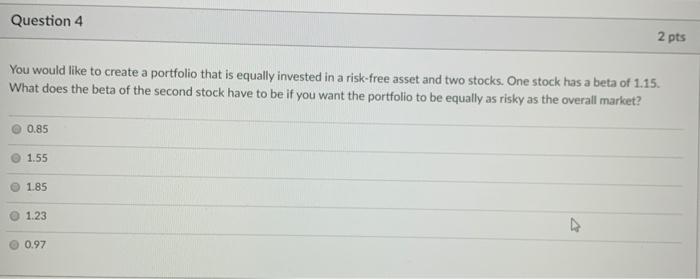

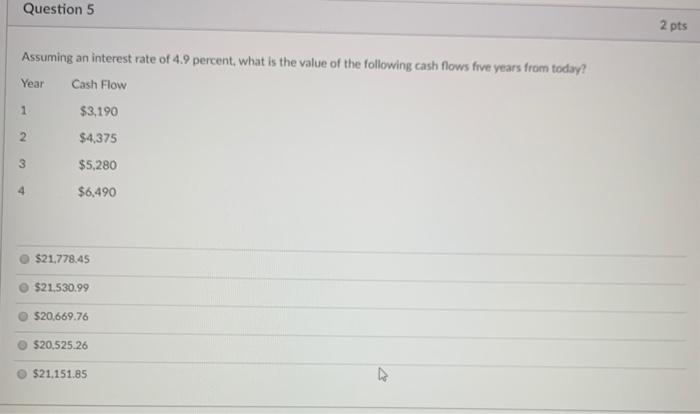

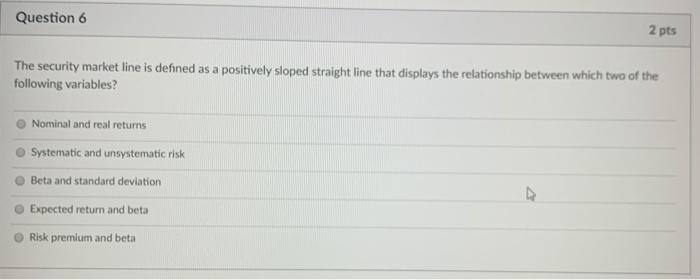

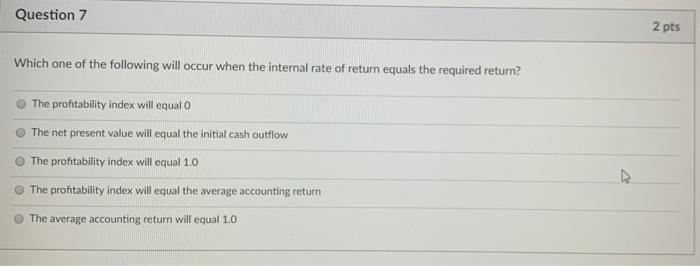

Question 4 2 pts You would like to create a portfolio that is equally invested in a risk-free asset and two stocks. One stock has a beta of 1.15. What does the beta of the second stock have to be if you want the portfolio to be equally as risky as the overall market? 0.85 1.55 1.85 1.23 0.97 Question 5 2 pts Assuming an interest rate of 4.9 percent, what is the value of the following cash flows five years from today? Year Cash Flow $3,190 2 $4,375 1 3 $5,280 $6,490 $21.778.45 $21.530.99 $20.669.76 $20.525.26 $21.151.85 Question 6 2 pts The security market line is defined as a positively sloped straight line that displays the relationship between which two of the following variables? Nominal and real returns Systematic and unsystematic risk Beta and standard deviation Expected return and beta Risk premium and beta Question 7 2 pts Which one of the following will occur when the internal rate of return equals the required return? The profitability index will equal o The net present value will equal the initial cash outflow The profitability index will equal 1.0 The profitability index will equal the average accounting return The average accounting return will equal 1.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts