Question: Question 4 (20 marks) a) Suppose the spot ask exchange rate, Sa($ ), is $1.90 = 1.00 and the spot bid exchange rate, Sb($|), is

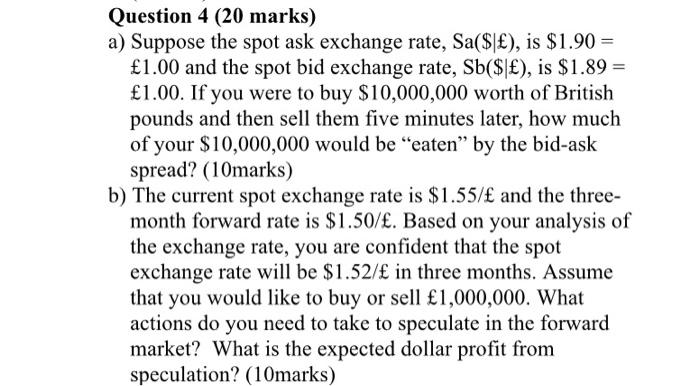

Question 4 (20 marks) a) Suppose the spot ask exchange rate, Sa($ ), is $1.90 = 1.00 and the spot bid exchange rate, Sb($|), is $1.89 = 1.00. If you were to buy $10,000,000 worth of British pounds and then sell them five minutes later, how much of your $10,000,000 would be "eaten" by the bid-ask spread? (10marks) b) The current spot exchange rate is $1.55/ and the three- month forward rate is $1.50/. Based on your analysis of the exchange rate, you are confident that the spot exchange rate will be $1.52/ in three months. Assume that you would like to buy or sell 1,000,000. What actions do you need to take to speculate in the forward market? What is the expected dollar profit from speculation? (10marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts