Question: QUESTION 4 (20 MARKS) A U.S multinational company (MNC) is facing translation exposure from its subsidiary in the U.K. You, as a manager of the

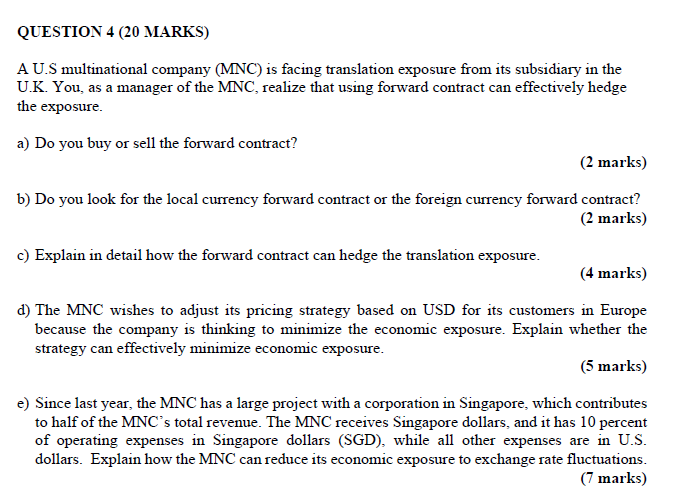

QUESTION 4 (20 MARKS) A U.S multinational company (MNC) is facing translation exposure from its subsidiary in the U.K. You, as a manager of the MNC, realize that using forward contract can effectively hedge the exposure. a) Do you buy or sell the forward contract? (2 marks) b) Do you look for the local currency forward contract or the foreign currency forward contract? (2 marks) c) Explain in detail how the forward contract can hedge the translation exposure. (4 marks) d) The MNC wishes to adjust its pricing strategy based on USD for its customers in Europe because the company is thinking to minimize the economic exposure. Explain whether the strategy can effectively minimize economic exposure. (5 marks) e) Since last year, the MNC has a large project with a corporation in Singapore, which contributes to half of the MNC's total revenue. The MNC receives Singapore dollars, and it has 10 percent of operating expenses in Singapore dollars (SGD), while all other expenses are in U.S. dollars. Explain how the MNC can reduce its economic exposure to exchange rate fluctuations. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts