Question: QUESTION 4 (20 MARKS) Alisya is considering adding toys to her gift shop. She estimates that the initial cost will be RM9,000. Toy sales are

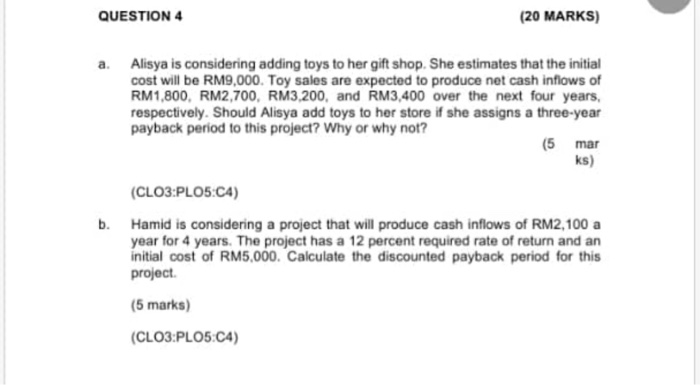

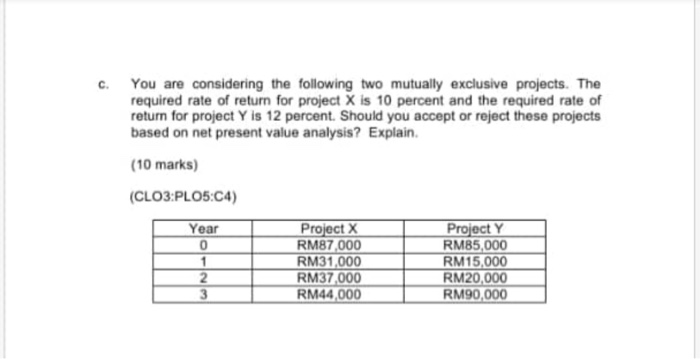

QUESTION 4 (20 MARKS) Alisya is considering adding toys to her gift shop. She estimates that the initial cost will be RM9,000. Toy sales are expected to produce net cash inflows of RM1,800, RM2,700, RM3,200, and RM3,400 over the next four years, respectively. Should Alisya add toys to her store if she assigns a three-year payback period to this project? Why or why not? (5 mar ks) (CLO3:PLO5:04) Hamid is considering a project that will produce cash inflows of RM2,100 a year for 4 years. The project has a 12 percent required rate of return and an initial cost of RM5,000. Calculate the discounted payback period for this project (5 marks) (CL03:PL05:04) c. You are considering the following two mutually exclusive projects. The required rate of return for project X is 10 percent and the required rate of return for project Y is 12 percent. Should you accept or reject these projects based on net present value analysis? Explain (10 marks) (CLO3:PLO5:04) Year 0 Project X RM87,000 RM31,000 RM37,000 RM44,000 Project Y RM85,000 RM15,000 RM20,000 RM90,000 UN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts