Question: Question 4. (20 marks) Consider a stock whose price process, denoted by {St}te[0,1], is assumed to follow the process dS7 = pt Sidt + Of

![by {St}te[0,1], is assumed to follow the process dS7 = pt Sidt](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6703df09ea2fd_9536703df0961cdd.jpg)

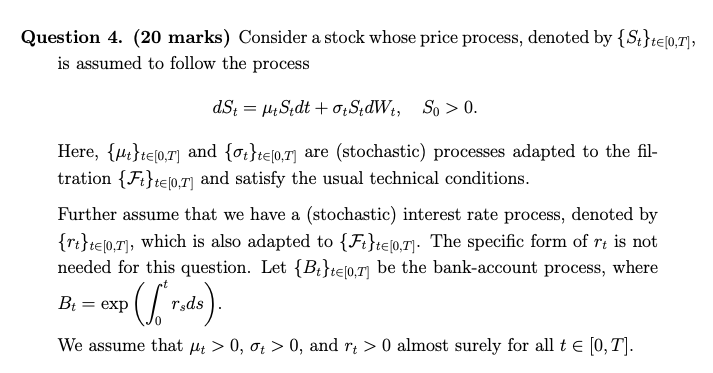

Question 4. (20 marks) Consider a stock whose price process, denoted by {St}te[0,1], is assumed to follow the process dS7 = pt Sidt + Of SidWt, So > 0. Here, {ut}te(0,7) and {Ot}te[0,1] are (stochastic) processes adapted to the fil- tration {Ft}te[0,7) and satisfy the usual technical conditions. Further assume that we have a (stochastic) interest rate process, denoted by {rt}te[0,1], which is also adapted to {Ft}te[0,1]. The specific form of rt is not needed for this question. Let {Bt}te[0,7] be the bank-account process, where B= exp P (Sr.dk) We assume that ft > 0, 0+ > 0, and rt > 0 almost surely for all t (0,T). We define the stochastic process { Z1}te[0,1], where 2. = exp(-IWW.- 1/ zadu), ="** Consider P: FR given by F(A) = (w)dP(w), AEF. a. (5 marks) Prove that {Zt}te[0,7) is a martingale by showing that Zt = 20 [cuZyaW., t (0,7). Mathematically justify why EP (ZT) = 1. b. (5 marks) Show that P is a legitimate probability measure. C. (5 marks) Consider the process {W}elo.7where W = Wc + a du. Show that {W} is a Brownian motion under P. te[0,1] d. (5 marks) Consider a portfolio Ot = (at, bt) of X, = (St, Bt) with the value process {V1}te(0,7), where V1 = 0; Xt. V Prove or disprove the assertion: Bt Ste(0,1) is a martingale with respect to (B. (Fileep) Question 4. (20 marks) Consider a stock whose price process, denoted by {St}te[0,1], is assumed to follow the process dS7 = pt Sidt + Of SidWt, So > 0. Here, {ut}te(0,7) and {Ot}te[0,1] are (stochastic) processes adapted to the fil- tration {Ft}te[0,7) and satisfy the usual technical conditions. Further assume that we have a (stochastic) interest rate process, denoted by {rt}te[0,1], which is also adapted to {Ft}te[0,1]. The specific form of rt is not needed for this question. Let {Bt}te[0,7] be the bank-account process, where B= exp P (Sr.dk) We assume that ft > 0, 0+ > 0, and rt > 0 almost surely for all t (0,T). We define the stochastic process { Z1}te[0,1], where 2. = exp(-IWW.- 1/ zadu), ="** Consider P: FR given by F(A) = (w)dP(w), AEF. a. (5 marks) Prove that {Zt}te[0,7) is a martingale by showing that Zt = 20 [cuZyaW., t (0,7). Mathematically justify why EP (ZT) = 1. b. (5 marks) Show that P is a legitimate probability measure. C. (5 marks) Consider the process {W}elo.7where W = Wc + a du. Show that {W} is a Brownian motion under P. te[0,1] d. (5 marks) Consider a portfolio Ot = (at, bt) of X, = (St, Bt) with the value process {V1}te(0,7), where V1 = 0; Xt. V Prove or disprove the assertion: Bt Ste(0,1) is a martingale with respect to (B. (Fileep)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts