Question: Question 4 (20 marks) Hello! Please COMPLETE PARTS D & E ONLY Use the following information for parts D to E. The following table is

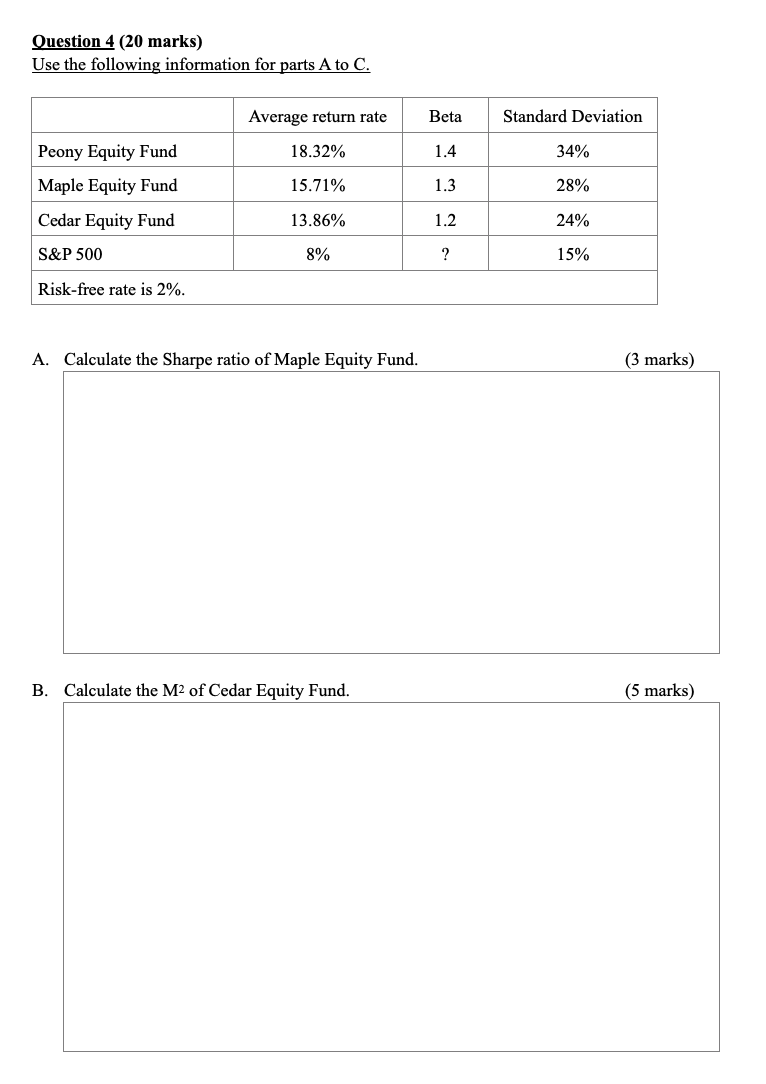

Question 4 (20 marks)

Hello! Please COMPLETE PARTS D & E ONLY

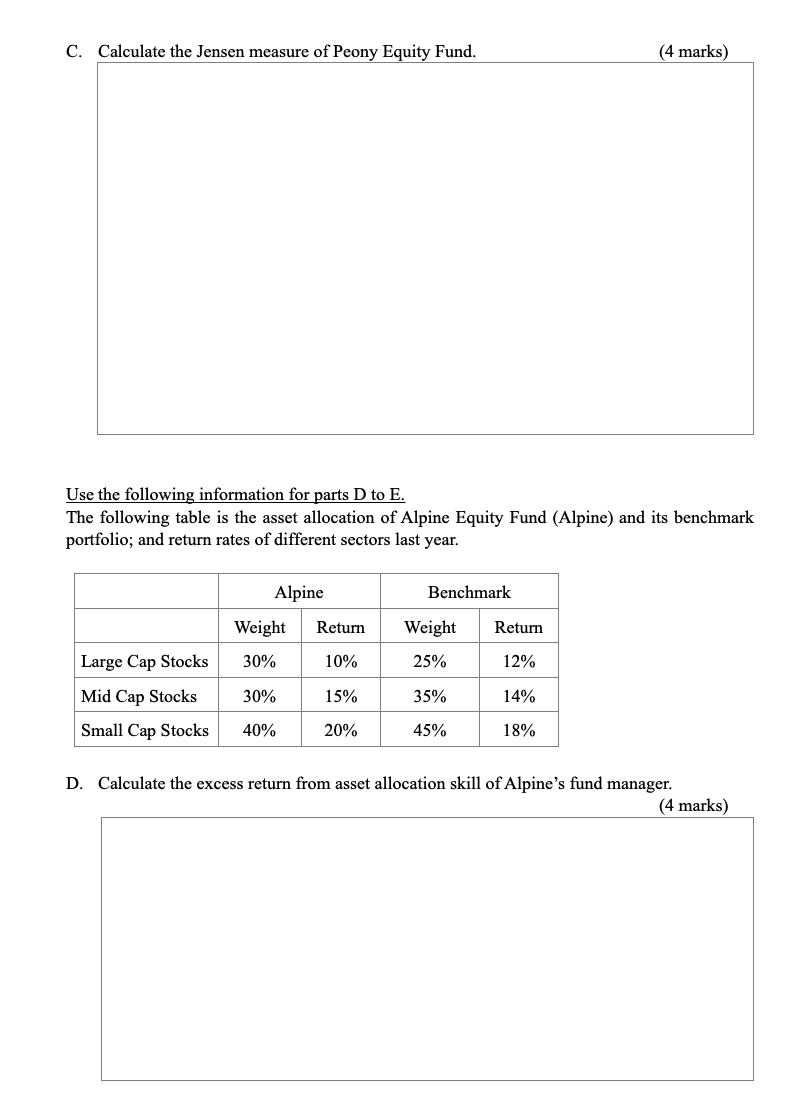

Use the following information for parts D to E.

The following table is the asset allocation of Alpine Equity Fund (Alpine) and its benchmark portfolio; and return rates of different sectors last year.

| Alpine | Benchmark | |||

| Weight | Return | Weight | Return | |

| Large Cap Stocks | 30% | 10% | 25% | 12% |

| Mid Cap Stocks | 30% | 15% | 35% | 14% |

| Small Cap Stocks | 40% | 20% | 45% | 18% |

D. Calculate the excess return from asset allocation skill of Alpines fund manager.

(4 marks)

E. Calculate the excess return from security selection skill of Alpines fund manager. (4 marks)

Question 4 (20 marks) Use the following information for parts A to C. Average return rate Beta Standard Deviation 18.32% 1.4 34% Peony Equity Fund Maple Equity Fund 15.71% 1.3 28% Cedar Equity Fund 13.86% 1.2 24% S&P 500 8% ? 15% Risk-free rate is 2%. A. Calculate the Sharpe ratio of Maple Equity Fund. (3 marks) B. Calculate the M2 of Cedar Equity Fund. (5 marks) C. Calculate the Jensen measure of Peony Equity Fund. (4 marks) Use the following information for parts D to E. The following table is the asset allocation of Alpine Equity Fund (Alpine) and its benchmark portfolio; and return rates of different sectors last year. Alpine Benchmark Weight Return Weight Return Large Cap Stocks 30% 10% 25% 12% 30% 15% 35% 14% Mid Cap Stocks Small Cap Stocks 40% 20% 45% 18% D. Calculate the excess return from asset allocation skill of Alpine's fund manager. (4 marks) E. Calculate the excess return from security selection skill of Alpine's fund manager. (4 marks) *** End of Paper ***

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts