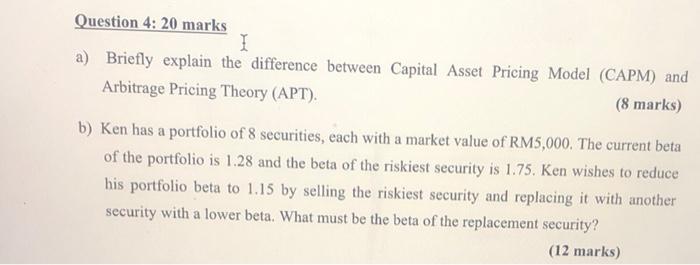

Question: Question 4: 20 marks I a) Briefly explain the difference between Capital Asset Pricing Model (CAPM) and Arbitrage Pricing Theory (APT). (8 marks) b) Ken

Question 4: 20 marks I a) Briefly explain the difference between Capital Asset Pricing Model (CAPM) and Arbitrage Pricing Theory (APT). (8 marks) b) Ken has a portfolio of 8 securities, each with a market value of RM5,000. The current beta of the portfolio is 1.28 and the beta of the riskiest security is 1.75. Ken wishes to reduce his portfolio beta to 1.15 by selling the riskiest security and replacing it with another security with a lower beta. What must be the beta of the replacement security? (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts